As the scope of an application or software expands, for most QAs staying in control poses the biggest challenges, as there is either a surfeit of tests or a deficit of tests. Both instances are undesirable. Because if you can’t run a comprehensive array of tests, you will end up bugs and vulnerabilities passing downstream and a poor-quality product, and alternatively if you fail to reduce the number of tests or work them out quickly, you might end up with massive pile up of tests – a bloated CI/CD pipeline. And when this happens, you might just end up “putting your hands up in the air” and demanding a postponement of the release. Much to the chagrin of the business owners who will lose precious time and competitive advantage.

The Kind of Tests Programmers Run during SDLC

The job of programmers or QAs is not easy, they run reams and reams of codes, write codes from scratch, and decipher the gaps/bugs/vulnerabilities with little help apart from the coding libraries and their experienced seniors. As a runup to the SDLC, a programmer or a QA will run tests such as:

- Integration tests: for finding out whether the components merge in the larger subsystem; interact with other components and whether the data flow is smooth or not, along with testing the interfaces and contracts for compatibility, environment testing, and testing scenarios.

- Smoke tests: a smoke test checks if the basic functionalities of the software are working properly before proceeding with more comprehensive testing.

- Release to beta users: gather valuable insights, identify and address issues early, and ensure that the final release meets user expectation

- Regression testing: The purpose of regression testing is to verify that previously tested and working features of the software continue to function correctly after modifications or enhancements have been made. It helps ensure that changes in one part of the software do not adversely impact other parts.

Most of the time the tests that are underlined above run in parallel. As there are a million things that programmers or QA teams must address at one and the same time, the chances of queues building up when you are working manually or have not invested in an end-to end automated system, for facilitating testing, are inordinately high.

Testing queues: An emblematic problem with software testing

Software testing queues present a notable challenge in the realm of testing, causing difficulties for programmers when juggling multiple tasks and determining priorities. They face the dilemma of whether to focus on resolving the existing test issues or addressing the previously identified bug that exposes a vulnerability, all the while contending with overflowing pipelines. Alongside the issue of bloated testing, additional concerns arise from problematic code stemming from legacy systems and a lack of documentation, insufficient resources, and strict deadlines, resulting in unnecessary apprehension. Furthermore, programmers are burdened with handling environmental matters, such as configuring a test environment to resemble the production environment, grappling with intricate and hard-to-isolate bugs, and effectively managing test data. These manual processes consume a significant amount of time. Hence, there arises a necessity for a platform that combines artificial intelligence/machine learning (AI/ML) and robotic process automation (RPA) to expedite the testing process while ensuring efficiency, transparency, and accuracy.

Meet the QA Companion: Turbocharging the SDLC

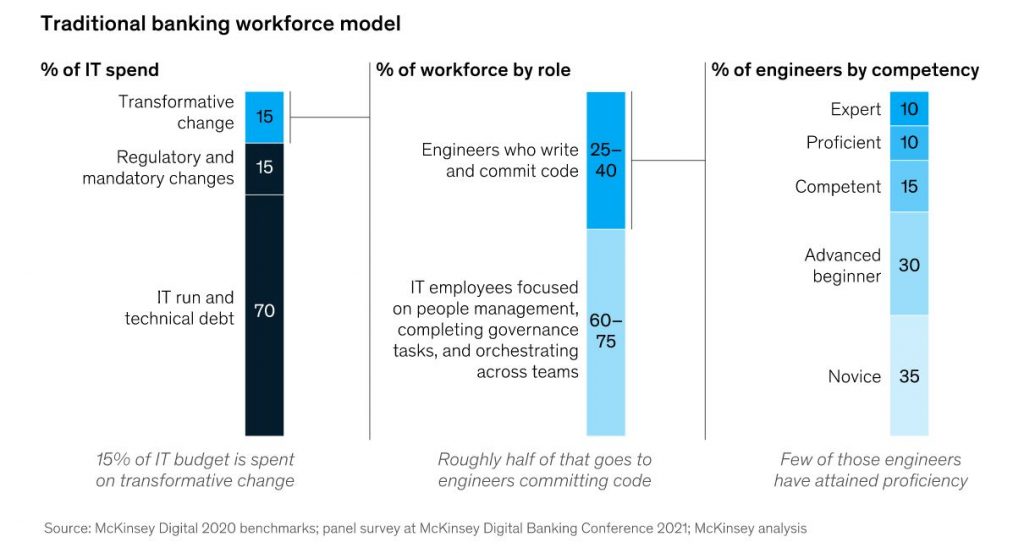

If there is an area where AI is silently revolutionizing, it is the software development lifecycle, encompassing not only coding tasks but also quality assurance (QA). According to a McKinsey study, generative AI can accelerate coding tasks by up to twice the speed, while AI’s role in QA serves as a key differentiator, ensuring quality, transparency, and timeliness.

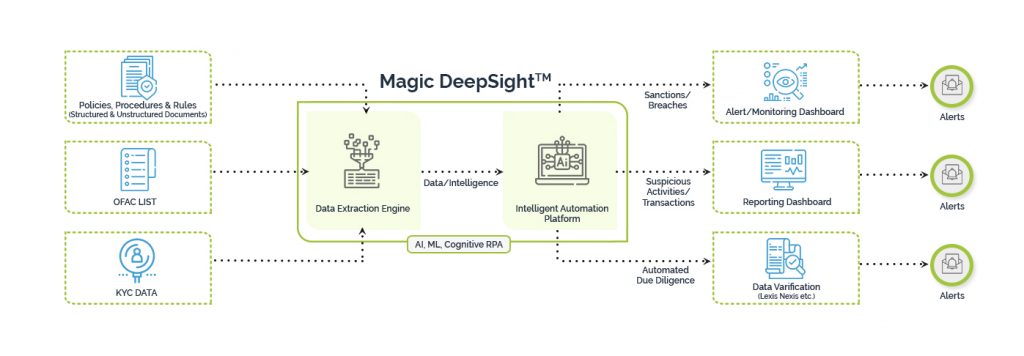

Magic FinServ’s QA companion, powered by AI, addresses all testing challenges throughout the SDLC. This intelligent solution takes care of tedious, repetitive, and complex testing aspects. With its exceptional intelligence and intuitive nature, it automates tasks, enabling developers to build high-quality software and achieve faster and more reliable release cycles, even when dealing with extensive test suites and challenging tests. Moreover, it provides actionable insights based on its built-in intelligence.

- By efficiently handling humongous amounts of data, surpassing previous capabilities, the QA companion mitigates risks and reduces unnecessary redundancy simultaneously.

- AI-assisted testing eliminates friction between teams.

- The AI-assisted QA Companion takes on most of the demanding tasks, resulting in a highly enriching and empowered developer experience, promoting workplace efficiency.

- Lastly, developers no longer need to rely on more experienced colleagues for assistance, as QA can fulfill their needs by explaining new concepts, synthesizing information, and providing step-by-step guides.

Unique selling points of Magic FinServ’s QA Companion

The QA companion serves as a reliable aid in navigating the SDLC, offering automation and intelligent code generation that far surpasses human capabilities in terms of time efficiency. Here are some key features that highlight the value of the QA companion for programmers and QA teams:

- Effortlessly track and communicate testing progress in a highly effective manner with the help of the QA companion.

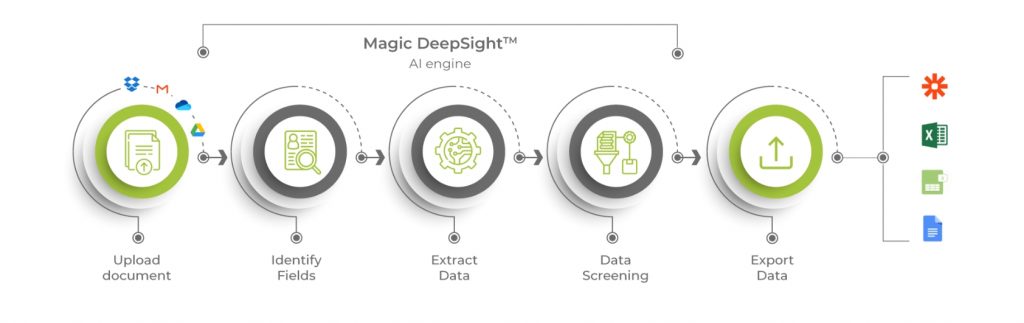

- Seamlessly process data from various file types, including handwritten notes.

- Utilize the in-built test scenario generator to produce intelligent test cases and scenarios, ensuring the pursuit of only necessary test cases and preventing test bloating.

- Download AI-generated test cases and scenarios in any desired file format, customizable to meet user output requirements.

- Generate automated scripts and eliminate the tedium associated with writing code from scratch multiple times.

- Manual scripting becomes unnecessary as the QA companion supports a wide range of scripting languages, such as Python, Java, JavaScript, C++, and more.

- Experience the benefits of a streamlined testing process within agile workflows, integrated with Agile tools like JIRA.

- Leverage the code optimizer’s smart detection technology to identify best practices, code smells, and vulnerabilities.

- Generate high-quality reports, including test plans, test strategies, execution reports, and more.

- Ensure continuous testing throughout your development pipeline, guaranteeing quality at every stage.

- Accelerate time to market by shortening project/product deployment times, gaining a competitive edge in the market.

Now you can bid goodbye to all the juggling between tests as the QA companion not only allows you to carry out tests in parallel tests without getting lost, but it also ensures that you are in control when it comes to timelines and releases. For a more comprehensive discussion on what the QA Companion can do and its role in Financial Quality Assurance and Quality Assurance in Financial Services, write to us at mail@magicfinserv.com