As an investment compliance team or an Asset Manager, one of the chief responsibilities is to monitor and administer the position holding of high-value institutional investors in a manner that is beneficial to the investor while meeting regulatory obligations. When it comes to investment monitoring, asset managers must ensure high levels of transparency. This is necessary as unethical practices such as short selling, account takeovers, disproportionate flow through, etc., not only harm the stakeholders’ interests but also result in massive fines and build a bad reputation. For example, an asset management company had been fined £7.2 million in 2013 for not heeding investment protection compliance regulations.

For private market investment, the buy-side asset manager (which acts as investor/LP) also needs to maintain transparency and identify or control the risk associated with their investment cash flow. To do this, the investment monitoring team gathers and monitors all the investment records and distribution received from the General Partner (GP) in a timely manner and relates this with the fund market value.

(A) What is Investment Monitoring in terms of Beneficial Disclosure and Position Limit Monitoring?

For asset managers and institutional investors who hold multiple securities (listed and traded) in a regulated market governed by different jurisdictions, shareholding disclosures continue to be a mammoth task. The challenge is further compounded by the fact that firms must also ensure compliance/make specific disclosure for:

- Investing in a sensitive industry

- Involvement in a takeover bid.

- Accumulating substantial shareholding in a security

- Engaging in short selling

- Monitoring Shareholder Information and Calculated % of Disclosure/Threshold

- Shareholder information pertaining to the company’s share capital data and voting rights

- Used for the calculation of the holding % ownership (threshold). When the value exceeds the threshold (depending on the jurisdiction) monitoring and reporting must be carried out accordingly.

Beneficial Ownership Reporting

“A beneficial owner is any individual who, directly or indirectly, owns or controls at least 25 percent of the ownership interest of the reporting company.”

Beneficial ownership reporting (against violation as per law defined by the jurisdiction) to the NCA (National Competent Authority). For example, Schedule 13/Form 13 filling to SEC in case the jurisdiction is in the US.

- Position Limit Monitoring

Position Limits represent the maximum number of holdings of the future/option contract corresponding to a given security.

The position limit or threshold is defined by regulatory bodies like CFTC, ESMA, etc., and the exchanges (CME, ICE, etc.) differently.

The investment manager must monitor the thresholds mentioned herewith and inform the respective bodies in case there is a violation.

- Exchange Position Limit: This limit is defined by exchanges like CME, ICE, etc.

- Regulatory Body: The regulatory body, for example, ESMA defines the position Limit in MiFID 2 Article 58/58

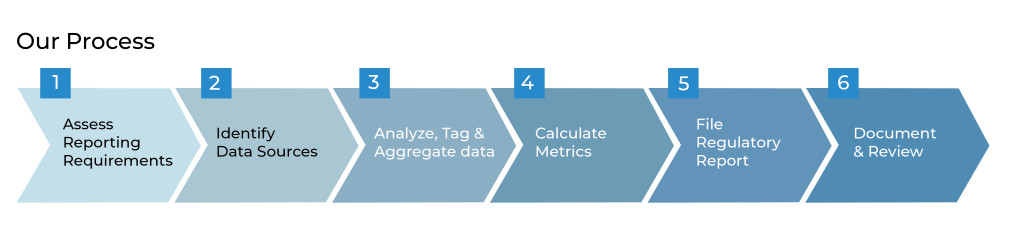

What does the typical investment monitoring workflow look like and why are asset managers not in control?

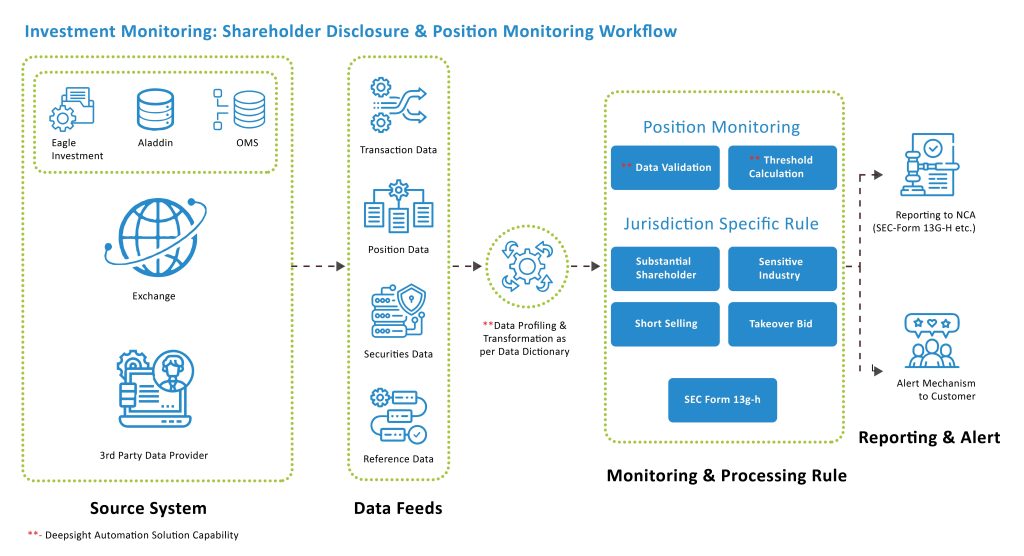

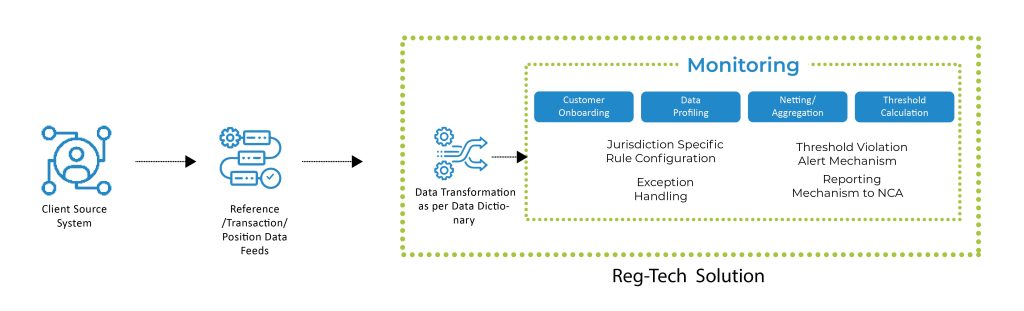

This is what a typical investment monitoring workflow looks like for Shareholder & Position Limit Monitoring:

When it comes to shareholding disclosures, here are some of the challenges that asset managers face:

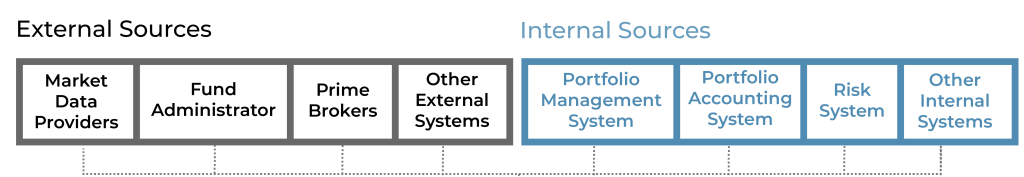

- Data Consolidation from Multiple Sources system (IMS, OMS, 3rd Party Data Provider, Exchange)

- New Customer Onboarding Challenges

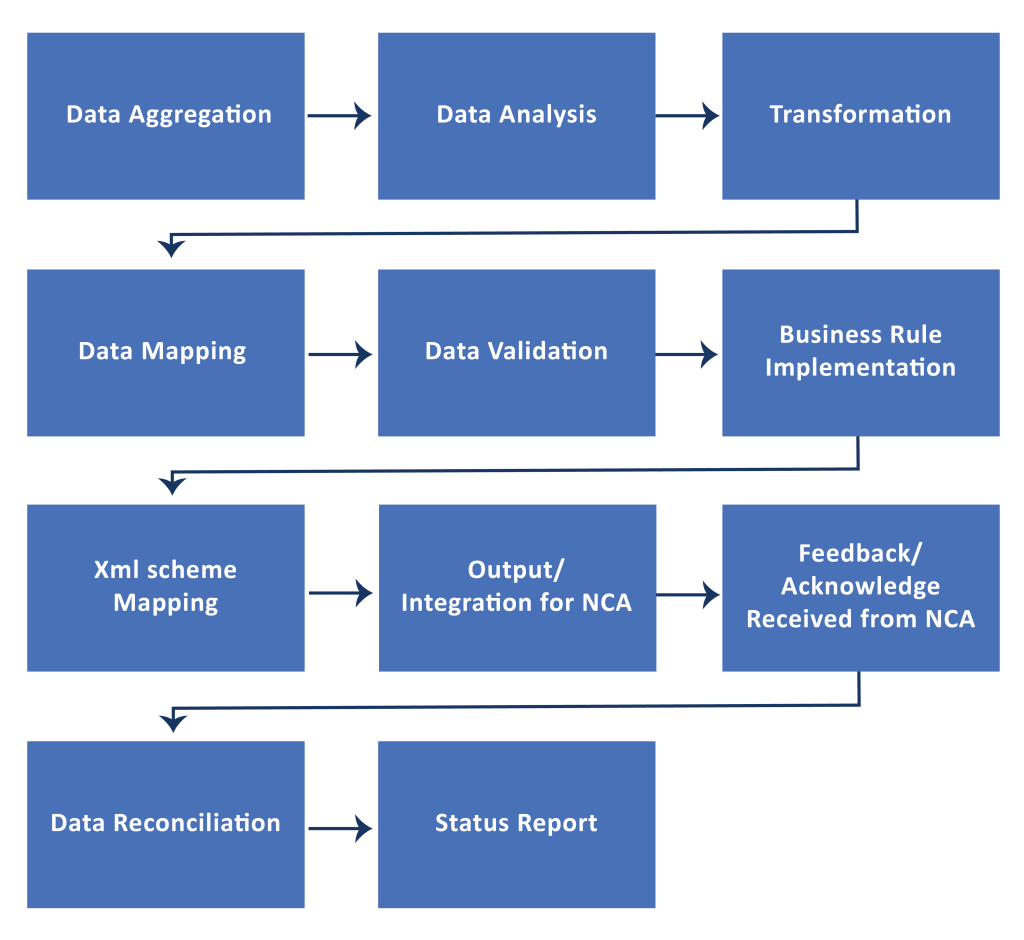

- Data Transformation, Tagging, Data Validation or Completeness.

- Netting/Aggregation of Position

- Monitoring the % Disclosure value on Timely manner due to dynamic effect of Corporate Action event.

Role of RegTechs!

When it comes to investment monitoring, it would be difficult to envision how to get things done without Regtech’s involvement. Regtech is the management of regulatory monitoring, reporting, and compliance within the financial industry through technology. Regtech systems can not only monitor the current state of compliance against upcoming regulations but ensure real-time compliance as well.

How Regtech Support the Business?

Challenges for RegTech?

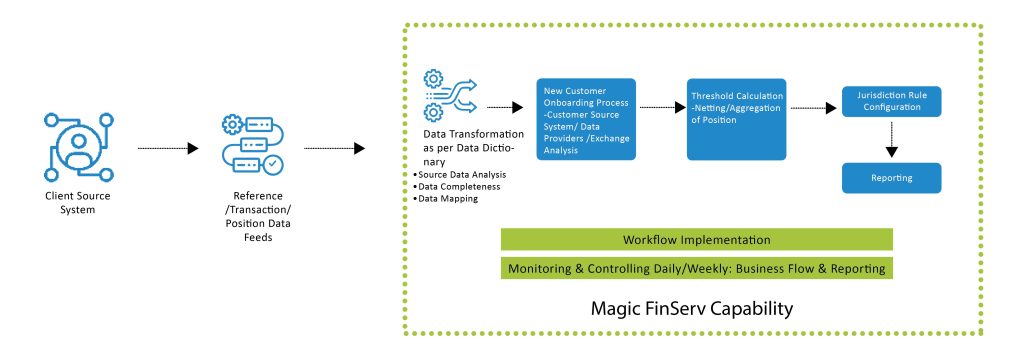

Magic FinServ’s Operational Model paves the Way for Change for both Reg-Tech Partner and Asset Management Firms:

Before embarking on a new journey with automation and analytics, firms must ensure that the mapping of data is accurate and complete. And herein lies the biggest challenge. You can onboard a platform or system, but if the system does not recognize the data or information, automation is pointless and real-time updates are skewed or not verifiable.

Biggest Obstacle to Automation is Data: Resolving the challenge the Magic Way with DeepSightTM

Unsurprisingly, despite the advancements in technology, what remains the biggest challenge for Asset Managers, Portfolio Managers, and Investment Managers is data, or rather the state of data. No prizes for guessing that correctly, for data is always at the center of controversy. If it is in good shape, organizations reap rich dividends by being on top of the game, but poor data is no good. When it comes to investment monitoring and the data conundrum, some of the chief concerns that asset managers and hedge funds face are:

- Data onboarding and transformation: client data is not in the required format and is scattered in silos: When you have heavy unstructured data, data ingestion takes longer than required.

- Data incompleteness or missing data points – Another concern is data lineage or finding the source of data which is critical for data transformation.

- Data validation – Checking the quality of source data before processing data.

- Collaboration among diverse teams and appropriate knowledge sharing is another key challenge.

At Magic FinServ, we believe that the Investment monitoring mechanism can be simplified by understanding the client’s compliance requirements first. We need to thoroughly analyze the client’s data files and understand what is it that they really need support with before – is it the lack of data, the incompleteness of data, the lack of understanding of the regulatory mechanism, or quite simply process simplification, before integrating the system or aligning the product to requirements.

This would also imply supporting the client in data transformation and reconciliation. This means cleaning the data, loading it, and validating it.

For example, let us consider a scenario wherein the senior leadership of a company “X” who are also shareholders of the company decides to short-sell to a bank or Venture Capital fund, which has also invested in the company and thereby are shareholders of the company. Now depending on the Regulatory policies as per corresponding jurisdiction, this is a clear violation of Threshold and must be reported to the regulatory bodies accordingly.

Now for alerts or triggers to be generated for action, there must be a clear-cut definition for raising an alert. However, this is not possible in a vacuum.

Processes must be streamlined, a rule-based system must choose accurately from the fields and columns of the data provided, and quickly raise alerts in case there is a discrepancy (or a cause for an alarm) and update it on the compliance system.

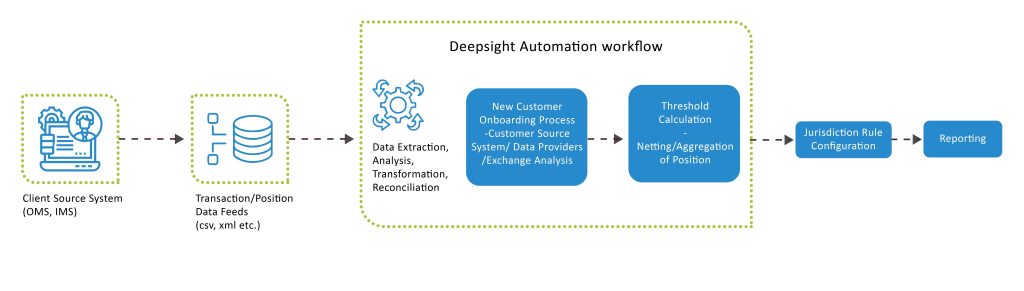

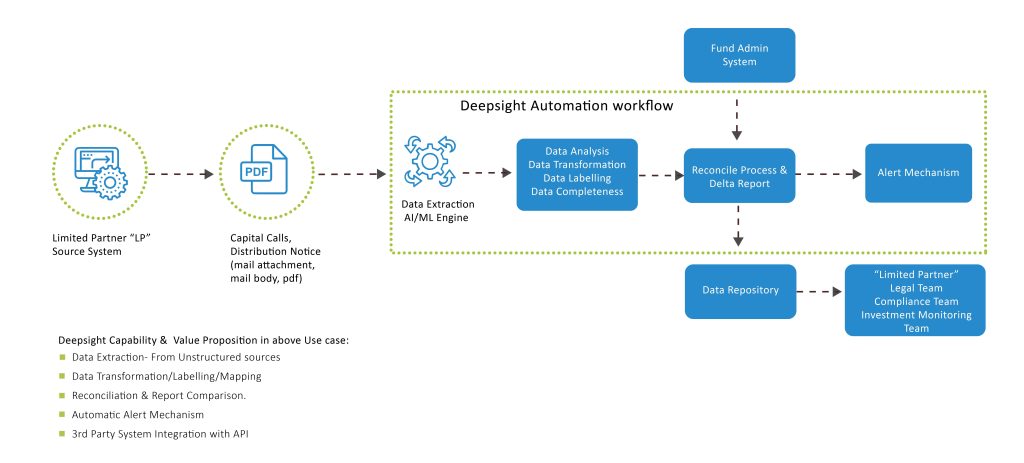

DeepSightTM AI/ML automation solution has the capability to extract relevant information from multiple sources and reconcile it based on any applicable business rules. Provided below are some use cases where automation can transform processes completely.

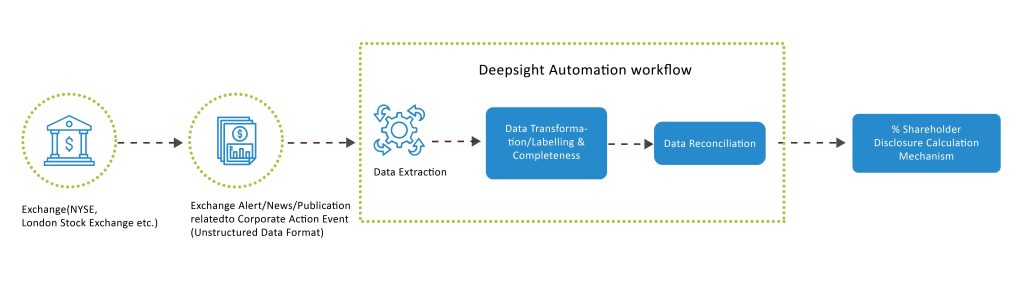

Use Case 1: Maintaining & Monitoring dynamic values of shareholder data and voting rights due to Corporate Action event in Timely manner

Firms must keep up to date with real-time values of company shareholder data and voting rights because any corporate action change can cause a material change to a company and affect its stakeholders. Information about corporate action is published in the form of news alerts or web links which are unstructured data sources. With DeepSightTM firms can automate shareholder-managed services and support the compliance monitoring team.

Speedier Migration and Quicker Transformation of Data with Magic FinServ

Systems do not understand data and its sources. Hence, implementation remains a challenge. Even the most perfect tools and platforms lack the comprehensive (and comprehending) power of humans. The biggest misconception that organizations fall prey to is getting an expensive tool and hoping it will automatically run one fine day. It simply does not work that way. The system does not understand the rules of the game (investment monitoring). It must be taught. It must be provided directions.

Helping the system understand.

And how does the system understand? It is possible only when both files are understood, and a one-on-one mapping is done. Thereafter, the rules are applied as per the defined jurisdiction or client requirement. And here’s how we can help.

So, for example, there is a new client that desires to use a tool/platform for investment monitoring of shareholding business. The cornerstone for setting up the tool is understanding the set of procedures required for running the data on the system daily. The workflow must be onboarded to the automation tool – the system.

However, before that, some files such as the security and position files are shared as a sample. Thereafter the mapping is done – map all the information in it (files shared) with the automation tool’s data scheme. When the schema is completed mapped, then only can the desired impact of automation for investment monitoring be perceived.

Use Case 2: Client Onboarding made easy with DeepSightTM

Generally, client onboarding on a system is a laborious affair if it is done manually. It is also highly expensive and error prone. With our Agile Project Management approach, we ensure speed and transparency even under the most excruciating of circumstances. Migration and transformation of data that was unusually long and laborious is streamlined. The results are evident more quickly as we ensure support to analysts and SMEs during all the critical milestones.

DeepSightTM simplifies new customer onboarding. It aggregates position values (based on regulatory rules) easily. It can facilitate the setup of an exception and alert mechanism when threshold limits are breached. Overall, our solution saves unnecessary costs and efforts, and by eliminating challenges related to data profiling, data completeness, and data lineage, ensures compliance with established standards.

By integrating and configuring the customer source system using DeepSightTM automation tool and including steps such as data profiling, data completeness, transformation, and mapping data, the process is made smoother without any manual intervention.

The biggest benefit that you get with Magic FinServ is a less irksome and less time-consuming client onboarding (on the compliance system for investment monitoring). With analysts spending less time monitoring the tools, your teams can engage in more productive tasks and leave us to take care of how real-time data will be integrated in the system.

(B) Investment Monitoring: Private Equity (PE) Investment by Buy-Side Asset Manager (Acts a Limited Partner (LP)

Now let us take the specific case of Investment monitoring by the Endowment Investment Institute, which is a Limited Partner in private equity, venture capital, and private market investment funds.

DeepSightTM helps customers manage all requests and documents in a digital library. The strategy for managing documents is based on the company’s investment fund strategy, making tracking, monitoring, and auditing processes easier.

It also helps customers manage and reconcile private equity fund cash flow information, along with other calculated values such as total commitment, funded commitment, recallable capital, and unfunded commitment for each private equity fund.

DeepSight’s AI/ML-enabled automation solution for Private Equity Fund can create Delta or Comparison reports based on internal data reconciliation and generate reports related to the Private Investment’s cash flow in a timely manner for each fund investment. It also creates alerts in case of any violations. It can also export information through an API or any other mechanism and generate reports using standard metrics.

Use case 3: Extract and reconcile data (from multiple sources) and carry out reporting for all the private equity investment cash flows and market value/fund performance:

With DeepSightTM ‘s automated solution, compliance, and investment performance teams can easily extract and reconcile all the cash flows and investment performance information from the structured and unstructured sources. Investment performance teams can also identify the delta and create an alert if the fund administrator fails to execute the order on time.

DeepSightTM can make things easier for you. For more on how we can be of help, write to us mail@magicfinserv.com