On May 2022, the offices of the Asset Management Company DWS and its majority owner Deutsche Bank in Frankfurt were raided based on allegations raised in the media that the company was resorting to a practice called Greenwashing, which simply means that their products or services were not as green as marketed or classified.

Greenwashing could happen either inadvertently or deliberately. But ever since Sustainable Finance Disclosure Regulation (SFDR) came into effect in March 2021, Morningstar estimated that 1800 funds have been upgraded or reclassified by their managers from Article 6 to Article 8, or from Article 8 to 9 without articulating why they have been redefined. Simultaneously, global regulatory agencies have also turned their attention to the ESG rating agencies.

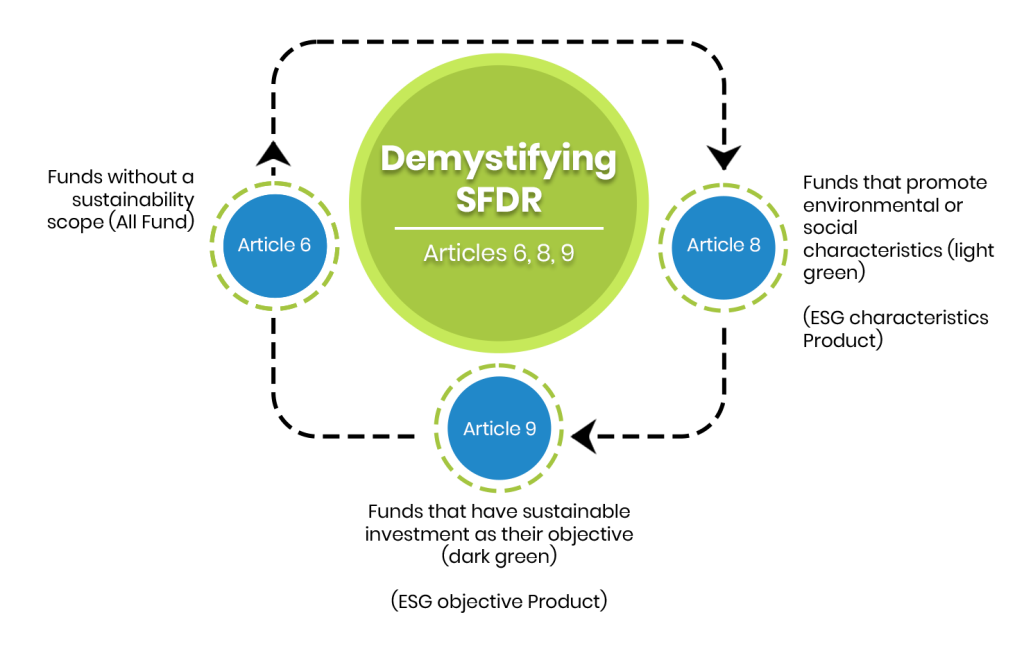

Simplified, the European Union Sustainable Finance Disclosure Regulation (SFDR) is a set of rules. These rules apply to the sustainability profile of funds so that end investors are able to decide better which fund to invest in by considering its adherence to the pre-defined metrics for measuring environmental, social, and governance (ESG) outcomes/factors. Central to the SFDR disclosure is Articles 6, 8, and 9.

Demystifying SFDR Articles 6, 8, 9

Article 6: Integration of Sustainability Risk

Financial market participants shall include descriptions of the following in pre-contractual disclosures:

- How the sustainability risks are integrated into their investment decisions; and

- The results of the assessment of the likely impacts of sustainability risks on the returns of the financial products they make available

Article 8: Promotion of Environmental or Social Characteristics

Financial product promotes, among other characteristics, environmental or social characteristics, or a combination of those characteristics, provided that the companies in which the investments are made follow good governance practices, the information to be disclosed pursuant to article 6 shall include the following:

- Information on how those characteristics is met.

- If an index has been designated as a reference benchmark, information on whether and how this index is consistent with those characteristics.”

Article 9: Transparency of Sustainable Investments

Where a financial product has sustainable investment as its objective (all assets be sustainable investments (with certain exceptions related to hedging or liquidity)) and an index has been designated as a reference benchmark, the information to be disclosed pursuant to article 6 shall be accompanied by the following:

- Information on how the designated index is aligned with that objective.

- An explanation as to why and how the designated index aligned with that objective differs from a broad market index.”

As a pension funds, sovereign funds, and family offices, the aim is to be as ethical as possible and invest only in Article 9 funds. Pension funds, for example, are associated with a social objective and hence these voluntarily choose not to invest in organizations investing in arms, tobacco, cannabis, etc., because the last thing that they would like to do is profit from such kinds of anti-social activities.

Therein lies the catch because sometimes it is difficult to ascertain/validate what happens in the supply chain by depending only on the quantitative data appearing on public websites. You could be investing in a company that is engaged in activities that are pursuant to the social and environmental good, but what if somewhere in the supply chain you are inadvertently investing in organizations associated with objectional activities both fiduciary like shell funds as well social such as drug trade, terrorism, etc.

So simply relying on structured information or data is simply not enough. In order to be complete and thorough, there is need to shift through tons of other data, top 10 holdings for example which could provide inputs on how sustainable a fund is. The onus, after all is on the investor to validate whether the funds are indeed article 9, and then decide whether to invest or not.

The Essence of SFDR

The ultimate priority of the European Union (EU) when it comes to Sustainable Finance is to develop a more sustainable economy, integrating environmental, social, and governance (ESG) factors across its core activities and enhancing the importance of sustainability risks.

“Sustainability risk’ on the other hand defines an ESG factor i.e., environmental, social or governance event or condition that in the event it occurs could cause an actual or a potential material negative impact on the value of the investment.

For sustainable economic growth, the European Union’s Legal team came up with the Regulatory and Disclosure framework SFDR that requires:

- As per EU SFDR regulation, review and validation of marketing material, pre-contractual disclosure, periodic contractual disclosure, and website disclosure

- Transparency of remuneration policies w.r.t integration of sustainability risks

- Consideration of Principal Adverse Impacts (PAI)

Through SFDR, transparency at both levels: Entity (Investment advisors, Asset Managers, etc) and Product (Fund) can be facilitated.

Entity Level

| Integration of sustainability risks into its investment decision-making processes. | Website Disclosure | Article 3 |

| Disclosure of Principal Adverse impacts (PAI) of investment decisions on sustainability factors | Website Disclosure | Article 4 |

| Integration of sustainability risks into Remuneration Policy | Website Disclosure | Article 5 |

Product Level

| Incorporation of sustainability risks into investment decision making and the impact of sustainability risks on fund returns. In this need to publish a PAI statement. | Pre-Contractual Disclosure | Article 6 |

| Transparency of PAI at financial product level | Periodic Contractual Disclosure | Article 7 |

| Transparency of the promotion of environmental or social characteristics. Scope of Fund is Light Green fund | Pre-Contractual Disclosure | Article 8 |

| Disclosure ESG fund objective aligns with EU Taxonomy. Scope of the Fund is Dark Green funds | Pre-Contractual Disclosure | Article 9 |

| All Marketing material align with SFDR & EU Taxonomy for eligible fund (ESG) | Marketing content | Article 13 |

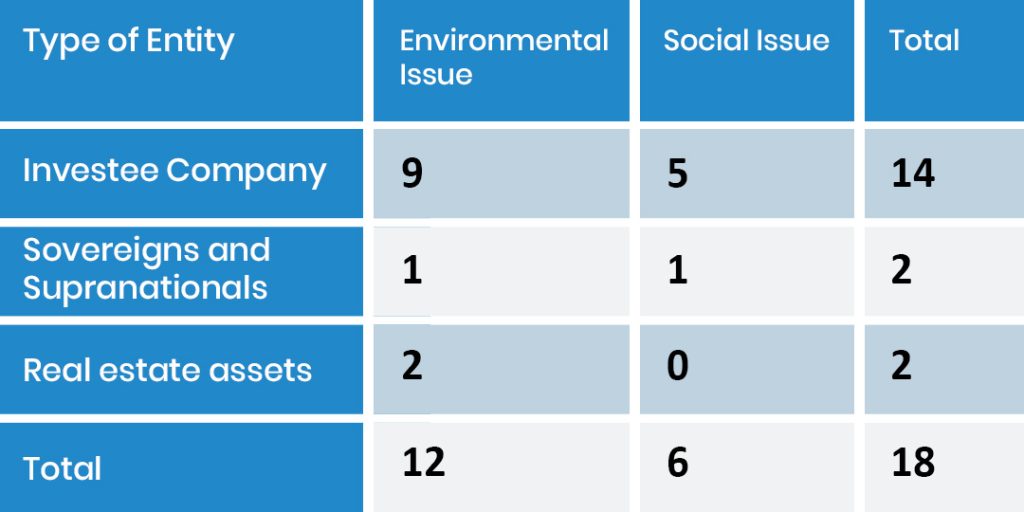

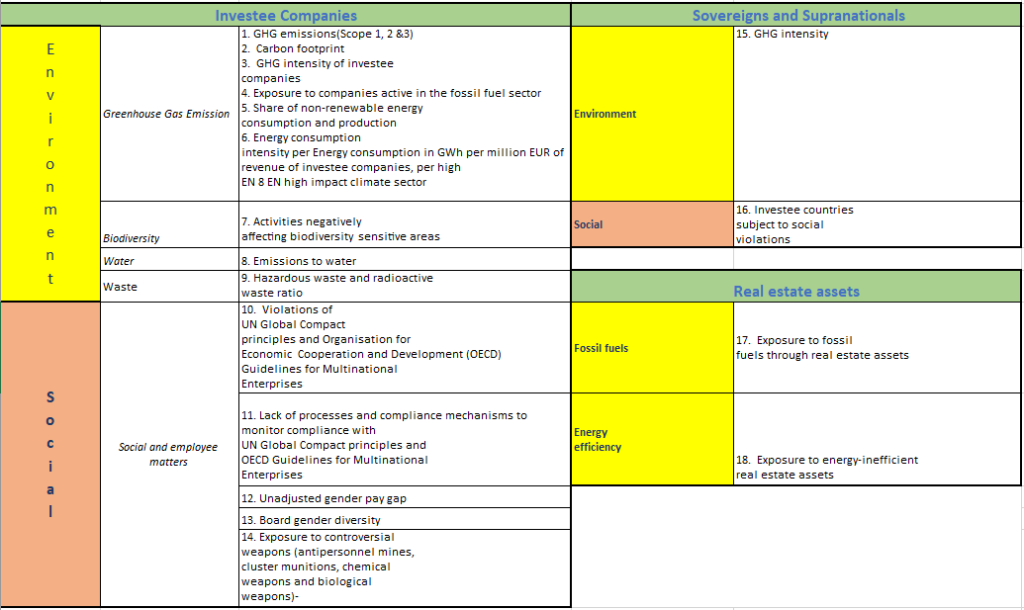

Principal Adverse Impacts (PAI) Indicators:

As per SFDR’s stipulations, there are 18 core indicators that must be mandatorily disclosed, and further 46 additional indicators that need to be reported. These are further classified into Investee Companies, Sovereigns and Supranational, and Real Estate Assets.

The 18 Mandatory Indicators:

Magic FinServ – Going the Extra Mile to Validate and Verify SFDR Disclosures and Elevate Due Diligence Process

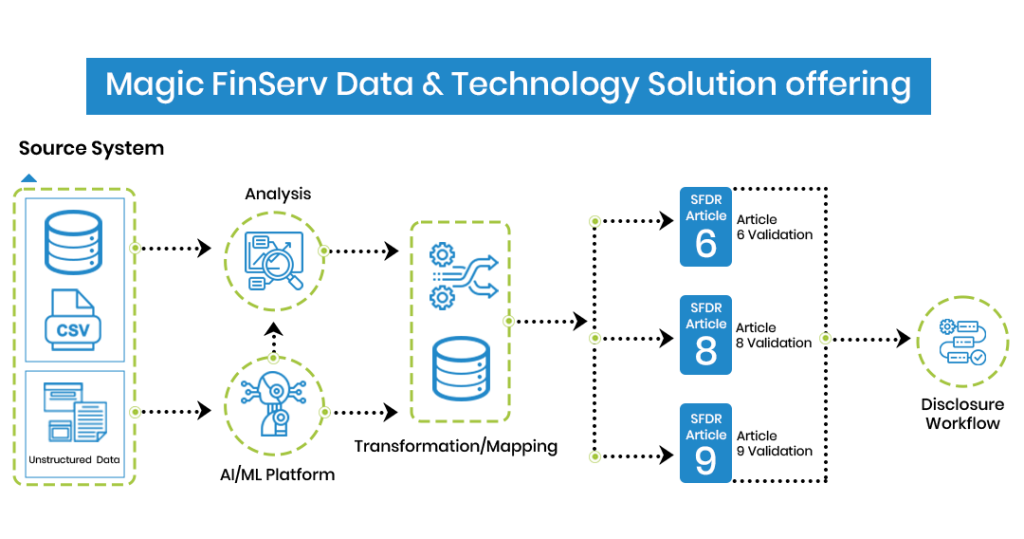

It is evident that a lot more data must be evaluated to extricate the genuineness of a fund with respect to Articles 6, 8, and 9. As an investor, you cannot rely solely on what data is available with Morningstar.

For a complete and thorough due diligence, to see if indeed the fund is sustainable, if it indeed has no major investment in a country that is blacklisted or associated with organizations involved or with exposure to controversial activities like weapons, one must dig deeper.

Magic FinServ’s DeepSightTM makes extraction of data from documents such as Form 13 F – a quarterly report filed by all institutional investment managers with at least $100 million in assets under management which discloses their equity holdings and provides insights into what the smart money is doing in the market, fund disclosure documents, fund strategies, investor documents, beneficial ownership that is a person/ group of individuals who enjoys benefits of ownership though the asset might be legally held by another person smoother and seamless and highly relevant. With DeepSightTM it is possible to parse through mountainous amounts of unstructured data and truly validate whether funds adhere to sustainability indices or are inadvertently Greenwashing.

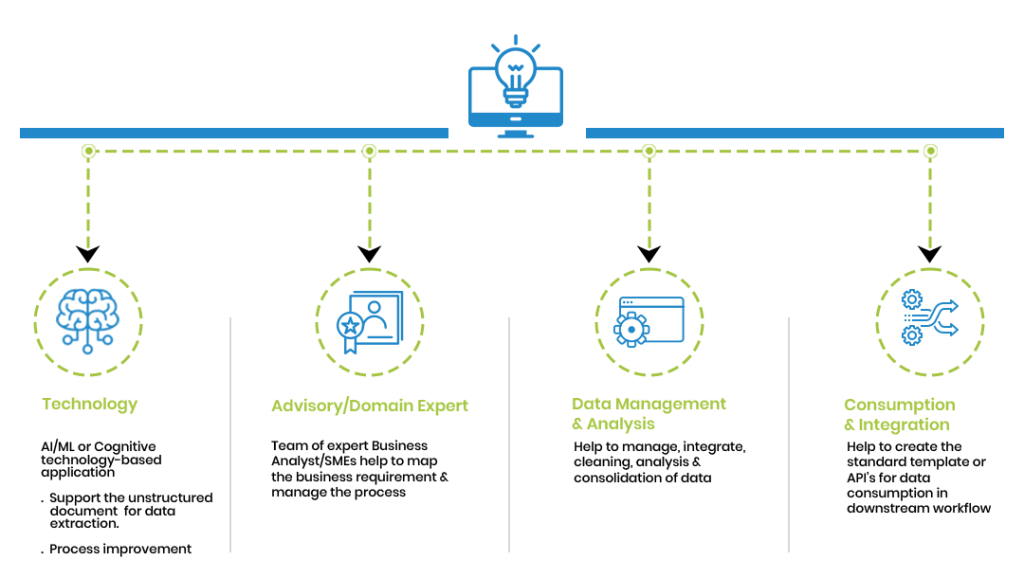

Here’s how Magic FinServ Data and Technology Offering elevates the whole SFDR disclosure and ensures due diligence.

Benefits

ESG Capability & Center of Excellence (CoE)

We have two different types of implemented Use case for SFDR workflow:

Fully Implemented of SFDR Ecosystem with Reg-Tech Partner: For a Global Reg-Tech product pertaining to Pre-Contractual and Periodic Disclosure, Magic FinServ implemented the SFDR workflow as per the regulatory deadline of Jan 2023, while also facilitating their business operation and data management services. Our service covered the entire end-to-end workflow including Managed Services, Customer Onboarding/Implementation services, Data Analysis & Management, Support of Change Management services and on demand application development (if feasible using Cognitive Technology).

Data Extraction, Transformation & Integration (Support both Unstructured & Structure Data source)-For an Asset Management company we aided the customer in the extraction of relevant information related to Customer Static Data, Benchmark Index, Indicator Value, Measurement and Calculated value, etc., all of which are closely associated with ESG Data. The data was extracted from their financial and regulatory disclosure document in an unstructured format. Eventually, this data was consumed by the SFDR disclosure workflow

So, if you too would like us to demonstrate how we can add value to your ESG journey, reach out to us at mail@magicfinserv.com.