Home » Improve AML process productivity with Magic DeepSightTM

INSIGHTS

Intelligent solutions. Informed decisions. Unrivaled results.

Improve AML process productivity with Magic DeepSightTM

Money laundering is a crime, a fraudulent activity to cleanse “dirty” money by moving it in and out of the financial system without getting detected. This takes a big toll on banks and financial institutions as they end up paying hefty fines and penalties for anti-money laundering breaches.

Often changes in regulations or sanctions convert otherwise legal money into “dirty” money requiring banks and FIs to report deposits and transactions and also freeze them. Inadvertently releasing these funds could also result in regulatory action.

Constantly changing rules of AML require retraining of staff, changes to workflows, and case tools. Until the staff becomes adept at the new rules, errors and omissions are a huge risk.

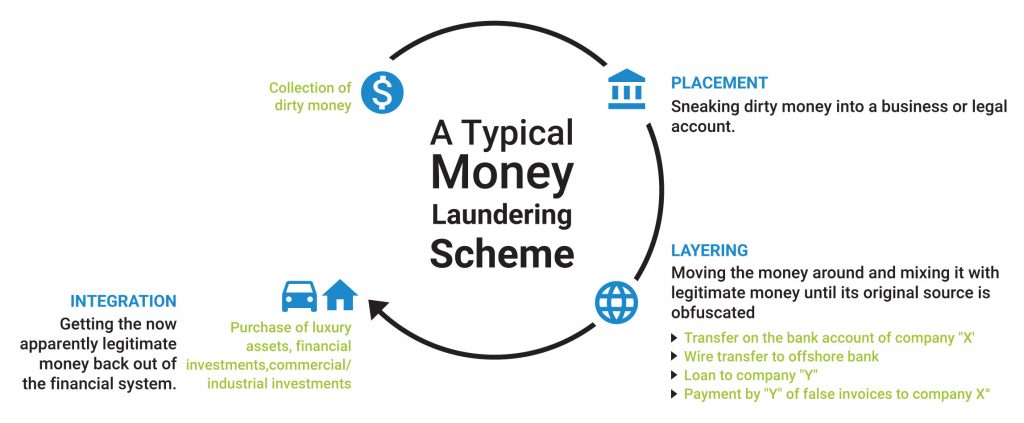

A typical money laundering scheme looks something like below.

- Collecting and depositing dirty money in a legal account.

- With banks in the US having a threshold limit of $ 10,000 in deposits scammers deposit lesser amounts to prevent detection using false invoices, made-up names, etc.

- Afterwards, they take out the dirty money via purchases of property and other luxury items through shell companies.

- With this process, money becomes legitimate, and they take out the money from the system.

With regulators across the world coming heavy on any financial institution found negligent of AML compliance, many banks, and financial institutions are turning to machine learning, big data, AI, and analytics for ensuring regulatory compliance and saving themselves the hefty penalties and fines or being named as a defaulter. They are also preventing the disruption to services when costly investigations ensue because of flaws or breaches in AML. Though AML compliance or processing can seem like a gigantic exercise, it is primarily all about collating data and drawing meaningful insights using advanced rules and machine learning.

Quality of data is either an impediment or an asset

Whether it is investigating anomalies, or raising the red flag in time, or ensuring accurate customer profiling (watchlist or sanctions screening), the quality of data is of paramount importance. It is either an impediment that is throwing false positives or an asset which streamlines processes and results in cost effectiveness and efficiency while ensuring compliance.

So, before you proceed with automating AML processing through use of automation tools and machine learning, you need to question -

Is my data clean?

While machine learning has multiple benefits, implementing it is not easy.

- As underlined earlier – data today is like many headed hydras – emanating from many sources, and in multiple formats – pdfs, invoices, emails, scanned text, spool files, etc.

- Good data is an asset and bad data an impediment resulting in poor decisions

- Most of the machine learning technology is all about identifying just the relevant data from terabytes of available data and self-learning over a period of time to become more efficient. However, this needs to be coupled with other technologies to help cleanse the data, and if you are not efficient at cleaning it, you will never get the desired results.

Unfortunately, most data-related work even today is primarily the responsibility of the back- end staff of banks and FIs. The manual process makes it expensive and time consuming. Not just that, human intelligence/capability limits the amount of data that can be optimally processed and hence results in potential errors and exposure.

Result - Delays, late filing of suspicious activity report (SAR), time, resources, and money wasted in investigations, poor customer experience (duplication of effort during Know Your Customer (KYC) and onboarding), potential politically exposed person (PEPS), offenders, and others on the watchlist evading detection, etc. When you fail to spot a suspicious transaction in time or scale up exponentially as per need, you end up bearing the burden of costly fines later.

Magic's DeepSightTM Solution raising the bar in fighting money laundering

AI and Machine Learning aided solutions help in finding patterns of unlawful movement of money like layering and structuring, deciphering suspicious activities in time, accurately identifying customers in the sanctions list, transaction monitoring, risk-based monitoring, investigations, and reporting for suspicious activities enterprise-wide. However, the efficiency of these tools is limited by the amount of clean data available. Enter Magic DeepSightTM , a tool leveraging AI, ML and a host of other automation technologies embedded with Rules Engines and Workflows to deliver extensive amounts of clean data.

Reading like a human but faster: Magic FinServ’s OCR technology and form parsing intelligence use advanced technologies like natural language processing (NLP), computer vision, and neural network algorithms to read like humans and infinitely faster. From tons of unstructured data in the form of text, character, and images, it figures out the relevant fields with ease. What is time-consuming and tedious for the average staff is made easy with Magic DeepSightTM .

Scaling data cleansing effort exponentially: The importance of cleaning data at scale can be realized from the fact that if it is not done at an exponential pace, machines will end up learning from untrustworthy data. Magic DeepSight™ leverages RPA, API and workflows to extract data from various sources, compare and resolve errors and omissions.

Keeping track of changing rules: AML rules keep changing frequently, people and entities sanctioned keep changing. In a manual operation, this is bound to cause problems. Magic DeepSight™ leverages Rules Engines where changes in rules can be updated to ensure uniform and complete adherence to new rules.

Identifying customers accurately even when information changes. Digitalization has amplified the efforts that firms have to put in for ensuring AML compliance. Customers move places, they change names, addresses, and other information that sets them apart. It is a tedious and time- consuming affair to keep up to date. Magic DeepSightTM resolves entities and identifies customers accurately.

Keeping pace with sophisticated transaction- monitoring: Transaction Monitoring is at the heart of anti-money laundering, with sophisticated means adopted by hackers requiring more than manual effort to ensure timely detection. Establishing a clear lineage of the data source is one of the foremost challenges that enterprises face today. Magic DeepSightTM can read the transactions from source and create a client profile and look for patterns satisfying the money laundering rules.

Act Now! Fight Fraud and Money Laundering Activities

The time to act is now. You can prevent money launderers from having their way by investing right in tools that can do the work of extracting data efficiently at half the time and cost and which can be integrated into your AML workflows seamlessly.

Our research data indicates that 45% of businesses that invested in more AI/ML deployments and had clearer data and technology strategies have fared relatively better in terms of garnering a competitive advantage than the remaining 55% that are still stuck in the experimental phase. Do not take the risk of falling further behind. Download our brochure on AML compliance to know more about our offerings or write to us mail@magicfinserv.com.