It’s the summer of pink.

Barbie, one of the most anticipated movies of the year, is finally here. Running a packed house and setting new records, Greta Gerwig’s Margot Robbie and Ryan Gosling movie has all rethinking the zeitgeist of the time which is certainly neither black nor white – it is pink.

Once frowned upon, 2023’s summer is splattered with pink; Anne Hathaway, the Princess of Wales, Margot Robbie, and others have worn Barbie’s favorite color on multiple occasions. But the zeitgeist of the Barbie movie is far more serious. It is a creative attempt to dispel many of the prevailing notions about gender stereotypes in a true Greta Gerwig manner. In particular, the kind of stereotyping that implies that blondes are dumb and wearing pink means that you are silly and not smart enough. With Barbiecore signaling an open rebellion against the notion of gender stereotypes, women (including trans women) across the world are embracing their femininity in a manner that would have seemed a bit overwrought in another time or year.

Organizations have 30 years of existence in the Financial Industry and are still subject to stereotypes.

Fintech companies have faced a unique and pervasive form of stereotyping in the business world. Despite the emergence of the first fintech pioneers like PayPal and Bloomberg over 30 years ago, these companies continue to be confined by various misconceptions. Some of the most prevalent stereotypes imposed on fintechs include the following:

- Fintechs are seen as mere disrupters, shaking up traditional financial systems.

- There is a perception that fintech primarily caters to Generation Z and young individuals.

- Fintech companies are often wrongly assumed to be unregulated, operating in a regulatory gray area.

- It is wrongly believed that fintech companies do not adhere to necessary compliance measures.

- Fintech is unfairly perceived as not actively promoting inclusivity in its services.

Spurred by the magic of the Barbie movie, we hope to rub-off many of the fintech stereotypes that exist even today, while pointing out the accessories/assets that fintechs require to nail the #barbiecore trend.

Dispelling the Stereotypes

Do fintech companies truly live up to their reputation as disrupters?

Financial technology solutions have stepped in to personalize, streamline, and enhance operations, leveraging open banking APIs to ensure accuracy, transparency, and efficiency. With processes speeding up and response times improving, the integration of Deep Intelligence in these applications provides up-to-date information. As a result, the traditional boundaries between disrupters (fintech) and the disrupted (banks and financial services) are gradually fading away.

Currently, there exists a strong collaboration between banks, financial services, and fintech companies, particularly in the back and middle offices, where manual and repetitive tasks were once overwhelming.

Are Fintechs exclusively serving the millennial generation?

In the beginning, fintech companies primarily focused on catering to the tech-savvy millennial generation. However, this is no longer true. The modern fintech industry is now actively targeting a broader customer base, including baby boomers and retirees who constitute 25% of America’s wealthiest population and will remain so until 2030. Fintech is now offering personalized content for portfolio management, timely advice, and up-to-date financial services, as well as fraud prevention, all of which can significantly empower seniors.

Do Fintechs abide by the same regulations as banks and financial institutions?

It’s intriguing to note that fintechs are now among the most heavily regulated businesses, primarily due to their significant investments in cutting-edge technologies such as cloud computing, artificial intelligence, and data analysis. Consequently, when there are changes or updates to regulatory rules or new amendments are introduced, fintech companies seamlessly incorporate these changes into their workflows and backend systems using automated and rules-based approaches, ensuring transparency, accuracy, and timeliness.

Dispelling the Notion that Fintechs neglect Diversity, Equity and Inclusivity

Nothing could be more wrong. Fintechs basic premise is inclusivity. They were the first to come out with an out-of-the-box approach and offer affordable, and customized services and solutions related to finance, mortgage, and loans processing to customers who could not approach the traditional banking and financial institutions. Today, fintechs have democratized finance and anyone can trade in stocks and decide how to manage their portfolios and make payments from the comforts of their home thanks to fintechs.

Fintechs have also taken the center stage when it comes to complying with ESG and DE&I. They are either showcasing their commitment to DE&I through vision and mission statement or have ensured that reporting pertaining to DE&I such as GRI (Global Reporting Initiative), Bloomberg, Refinitiv, etc., are fee or available at a price. Because either way the investor has the right to know.

While fintechs promote inclusivity in their business practices, their workspaces are one of the most diversified and equitable.

Reconsidering Compliance measures in the Fintech industry

Earlier, fintechs were not expected to follow the kind of rules and regulations that banks and other financial institutions had to comply with. Fintechs could therefore work out of the box and forge deep ties with the customer using personalized approaches and instill a degree of agility that was not possible earlier. However, there has been a sea change and fintechs today come under the ambit of the same rules and regulations that govern banks and FIs. Also, in the case of many fintech-bank collaborations, it is imperative for fintech to raise the bar and ensure compliance under all circumstances and hence the stereotype that fintech does not follow compliance measures does not apply.

Nailing the zeitgeist of the times with Magic FinServ

If Barbie uses fashion to defy gender stereotypes, fintechs rely on the cloud, AI-enabled tools and platforms to nail the prevailing zeitgeist of diversity, inclusivity, and acceptance. As an AI company, here’s how Magic FinServ has been changing the narrative around fintechs with tools, platform and resources.

Faster onboarding, KYC, and due diligence with DeepSight for CX, inclusivity, and regulation compliance

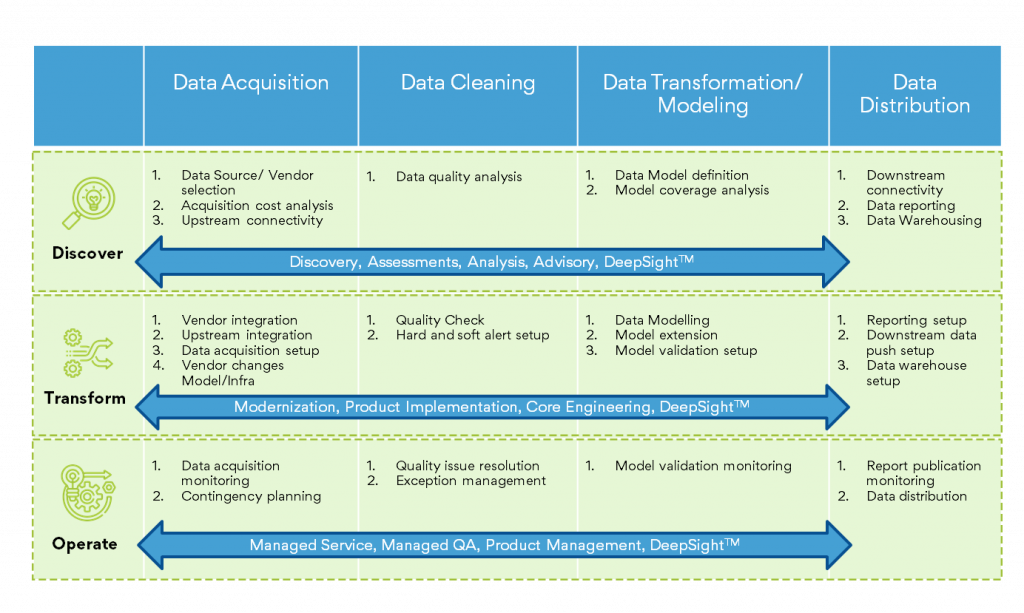

While the fashionistas can easily nail the Barbiecore trend as there is a flood of pink-colored clothing and accessories for both genders, for fintechs embracing the zeitgeist (diversity, inclusivity, and acceptance) would require some sea changes and increased levels of collaboration. For example, for swifter and streamlined onboarding, KYC, and due diligence, just investing in a powerful tool or platform is not enough. For quicker onboarding of customer data, DeepSight, an AI-driven platform ensures faster onboarding of customer data, while also using a rules-based approach that ensures that only relevant data points are extracted, which makes it easier to draw premises and make intelligent decisions quicker than ever before. Quick data onboarding and KYC delights the customer and results in highly engagement and inclusivity.

Relying heavily on automation for doing the heavy lifting with regards Testing, QA, and DevOps

When the whole world turns “pink” can you afford to be left behind. Whether it is day trading or payments or even loans processing, ease of communication with the customer is vital for creating a truly enriching customer experience.

However, for a truly great application or front-end, or for enabling a lean platform-centric model, there is a lot of heavy lifting that must be done at the backend. A good user-friendly interface is not built by magic. Behind the scenes teams of developers and QA work in tandem to build the product.

When backed by robust DevOps and Quality Assurance automation solutions such as Magic FinServ’s QA Companion, firms can deliver on the promised timelines without sacrificing the quality. Whether it is code commit, or coding bloating, or generating automated scripts so that manual effort is kept at a minimum and QAs have more time and effort in their hands to work on details related to personalization, UI/UX, and enhancing the customer experience.

Streamlining with Magic FinServ

As fintechs operate across multiple jurisdictions and subject to the same intense regulation as traditional financial institutions, compliance can be a challenge. The challenge is more so for banks that partner with fintech to access innovative technology. There are risks associated with data privacy and consumer protection, for example the Payment Card Industry Data Security Standard (PCI DSS) and the General Data Protection Regulation (GDPR) that must be addressed. As a fintech provider team up with the experts at Magic FinServ who have years of experience addressing such issues. We provide fintech consulting services that will help ensure transparency, efficiency, and productivity while meeting timelines for monitoring and reporting.

Get smart with our financial technology solutions and get going with barbie. For more write to us at, mail@magicfinserv.com.