Home » Regulatory Fund Reporting: Affixing the Nagging Headwinds with Streamlined Processes and Intelligent Tools!

INSIGHTS

Intelligent solutions. Informed decisions. Unrivaled results.

Regulatory Fund Reporting: Affixing the Nagging Headwinds with Streamlined Processes and Intelligent Tools!

In this world, headwinds are far more prevalent than winds from the astern (that is, if you never violate the Pythagorean maxim). - Author: Herman Melville

In our earlier blogs on investment monitoring and transaction regulatory monitoring, we provided a detailed description of the challenges that institutional investors, hedge funds, and asset managers face with respect to filing and monitoring of reports. And along with the challenges, the panacea – an automated rules-based solution that speeds up the data extraction process by a zillion times, enriches and transforms data with tags and maps, while integrating easily with the required workflow and facilitating last-mile process integration. So that regulatory filings no longer remain the nagging pain for business heads and analysts that arises every time it is filing time. And that is every quarter!

Here in this blog, we will be discussing another monumental legacy of entrepreneurship across the world -private equity funds. Along with it, the obstacles, or the headwinds that financial advisors to hedge funds, and hedge funds and asset managers themselves face while filing their reports such as form PF, and alternative asset management funds.

Considering that volatility of the markets, the inglorious end of the Credit Suisse chapter (plagued by constant reprimands from the regulators in the last couple of years for financial irregularities) and Silicon Valley Bank closure that is creating a ripple effect that reverberates throughout the financial and capital markets, and increasing pressure to conform to the regulatory requirements, this blog will be on how Magic FinServ and DeepSightTM purports to be the "wind beneath the wings."

What are the key filings?

We begin with a definition of the key filings and the historical relevance of these funds. In the global business eco-system, private equity funds hold an elevated place as these have not only resurrected or reinvigorated companies but have provided them with the much-needed capital leverage during their start-up or fledgling phase. You need to look no further than what is considered the most valuable company in the world today – Apple – which too received funds from private equity during the initial phases.

Because the funds in question are huge, hedge funds and asset managers, and financial advisors that manage them are required to ensure that risks are mitigated, and there is transparency. Some of the key regulatory filings that are applicable to funds include:

Form PF: A registered investment adviser with at least US$150 million of ‘private fund’ is required to file Form PF with the SEC, which requires disclosure pertaining to

- gross and net performance,

- gross and net asset value,

- the aggregate value of derivatives,

- a breakdown of the fund’s investors by category (e.g., individuals, pension funds, governmental entities, sovereign wealth funds),

- a breakdown of the fund’s equity held by the five largest investors.

- summary of fund assets and liabilities

- including Sections 2a (Aggregate Positions) for $1.5 billion in hedge fund assets under management, 2b (Risk Measure),

Form CPO-PQ: As per CFTC regulations most derivatives are included as ‘commodity interests’ that cause a private equity fund holding such instruments to be deemed a ‘commodity pool’ and its operator to be subject to CFTC jurisdiction as a CPO or its adviser (typically the investment adviser) to be subject to CFTC jurisdiction as a CTA, and, unless an exemption is available, to become a member of the National Futures Association (NFA), the self-regulatory organization for the commodities and derivatives market. Source: Regulation of private equity funds in USA.

Alternative Investment Fund Manager Directive (EU AIFMD): Any manager that operates a fund in the EU is subject to AIFMD regulation. The Alternative Investment Fund Managers Directive (AIFMD) is a European Union (EU) regulation that applies to alternative investments, many of which were left largely unchecked prior to the 2008-09 global financial crisis. The directive sets standards for marketing around raising private capital, remuneration policies, risk monitoring and reporting, as well as overall accountability.

Where does the challenge lie?

Finding the needle in the haystack: As apparent, the regulatory filing is a massive exercise involving humongous amounts of data from which relevant field items or data points must be picked. The entire process can be likened to finding a needle from a haystack. Manually filing and reporting is an extremely time-consuming exercise. It disrupts normal business as additional effort is required to process it in time. And to make matters worse, the manual approach is also massively error-prone

Lack of process standardization results in duplication of effort: When filing and reporting is being conducted manually, firms due to time constraints are not focusing on information generation, rather they try to meet the deadlines. Whether it is Form PF or Form CPO-PQR filings, the processes are different, and with no efforts made to standardize the information, firms end up going through the same set of information again and again. The absence of a centralized repository complicates results in rework. Creation of a compliance data repository for all the relevant and necessary data, as well as the creation of business values for calculating measures and risk metrics.

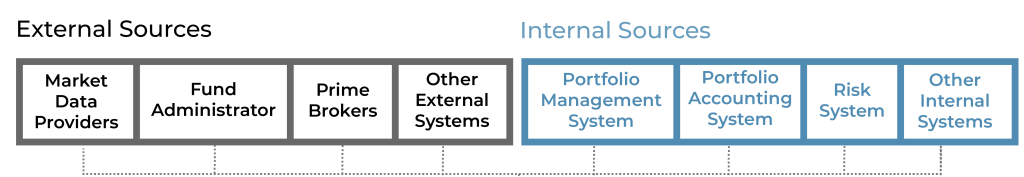

Different systems complicate processes: Another headwind is the task of compiling, netting, aggregating, and validating data from the different business ecosystems as each functions differently. Each ecosystem could rely on processes, approaches and workflows that are different from the others making it tough to validate and reconcile data.

Testing and creating a sample for automation. Ensuring last-mile process optimization and coordinating with the regulator

Lack of collaboration and process standardization are the headwinds: Siloziation culture, and lack of process standardization come in the way of timely and accurate filings. Working out a sync between internal and external parties - exchanges, data vendors, compliance teams, and third-party vendors so that important action items are not missed and reported in a timely manner constitutes another operational challenge.

Navigating the challenge with an automated and rules-based data-driven tool

In order to meet the Form PF and Form CPO-PQR filing requirements in a manner that is accurate, transparent, and up-to-date while ensuring that it is in consonance with the regulatory and compliance guidelines of SEC, CFTC, and European Union's AIFMD among others, hedge funds and asset managers must adopt a clear-sighted and streamlined approach that funnels the power of cutting-edge technologies such as artificial intelligence and machine learning while concentrating on data-centricity so that there is a centralized data repository, and streamlined processes that can be can be leveraged for optimal utilization of resources. In case there are additional filings for regulators in other jurisdictions as per need, streamlined processes can easily meet the need. It also requires a standardized data gathering and compilation process, and consistent data usage across business units.

An automated and rules-based approach tool is ideal for cutting the slack and for ensuring timeliness and accuracy, and we combine that with our knowledge in the financial services domain and our team of experts who are well-versed in the nitty-gritty of regulatory compliance practices to make fund regulatory filings a pain no more.

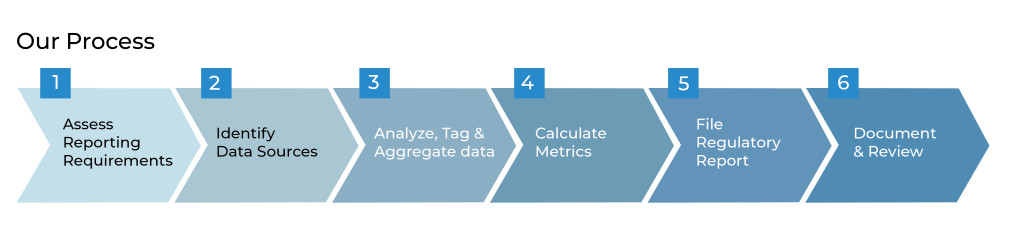

Here's how we can make monitoring and reporting streamlined and hassle-free.

The Roadmap

Assessing Needs and Gaps: Begin by assessing and analyzing the requirements.

- Find out what it is that the firm requires.

- What are the reports that are to be filed (Form PF, and Form CPO-PQ, and in addition additional investment)

Identify the sources of data, extract relevant data & transform data using DeepSightTM

Identify where it is that you get the data, the websites or external sources, and the internal systems such as the portfolio management system(IMS, etc.) What are the gaps that exist? What could have been an extremely complicated exercise, is simplified with DeepSightTM

Using a rules-based approach, and leveraging its AI and ML capabilities, DeepSightTM intelligently captures data from different sources – websites and internal systems and transforms it in a manner so that data is accurate, complete, and validate it.

Further, in case gaps exist, liaise with the data providers and exchange where requisite information can be available. Ensure that a golden copy of data is in a centralized data repository for further aggregation and analysis as per need.

Validating data and calculating key business values using DeepSightTM

Our powerful AI and Machine learning enabled DeepSightTM to analyze and validate data for completeness and accuracy. Data is enriched and categorized as well. Lastly, when it comes to the analysis of certain key elements required by Form PF, such as portfolio duration, turnover, liquidity, and market risk metric, DeepSightTM can be an invaluable ally.

Another key functionality of DeepSightTM is related to the calculation of key business values or metrices.

For more on what how we can make fund regulatory reporting less painful, reach out to us, at mail@magicfinserv.com