Home » Unravelling the Complexities of Shareholding Data Management with Magic FinServ’s Data & Technology Solution

INSIGHTS

Intelligent solutions. Informed decisions. Unrivaled results.

Unravelling the Complexities of Shareholding Data Management with Magic FinServ’s Data & Technology Solution

Managing shareholding data is a complex business. Understanding how corporate events such as buybacks, mergers and acquisitions, dividends, bonus shares, spin-offs, and others affect a company's total share outstanding value and total voting rights is even more complex due to the proliferation of often expensive data sources, complex shareholding disclosure rules, and multiple jurisdictions. Additionally, companies invest in multiple equities spread across diverse geographies, which further increases the complexity of the task. The data itself comes from various jurisdictions and exchanges in different formats, and changes are notified in different ways, which adds to the level of complexity. Therefore, analysts must be familiar with the form and type of notifications issued by various exchanges.

Another key concern is to maintain up-to-date shareholding information, including an account of the company's total outstanding shares, their value, and total voting rights. This information is critical not only from a fiscal and financial perspective - to calculate business growth, equity per dividend, and other downstream calculations - but also to ensure compliance with predefined compliance and disclosure rules.

Since the rules governing voting rights for a certain set of corporate actions differ across multiple jurisdictions, these actions could impact your beneficial interests due to indirect investments. To address these problems, data must be collated and extracted, incorporating the rules governing that data for the particular jurisdiction and updating their impact on the value of outstanding shares, voting rights, and more. It is critical to keep shareholding information up to date, as there have been serious consequences and hefty fines levied on Asset Managers, Hedge Funds, and Portfolio Managers in recent years for not being up to date with shareholding disclosures. For instance, French regulators recently penalized an activist fund and recommended a fine of 20 million Euros for failing to provide correct and timely information to the Autorité des Marchés Financiers (AMF) about a takeover bid, thereby harming the interests of minority shareholders and impacting the market's integrity.

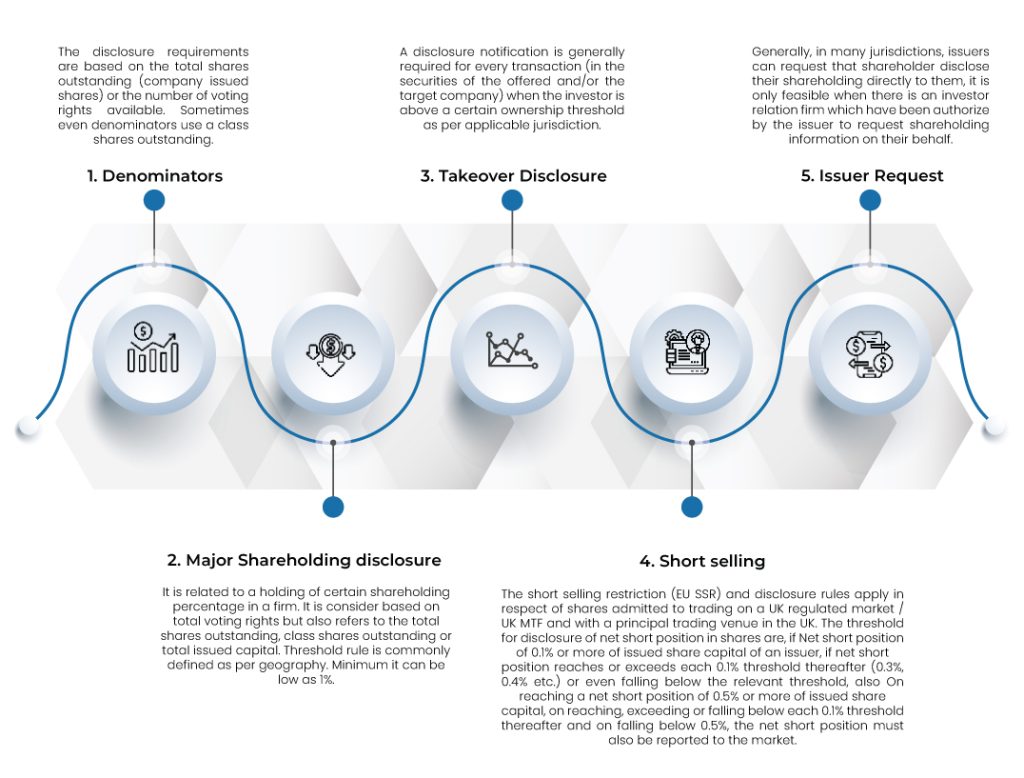

Decoding Shareholding Disclosure Rules

There are shareholding disclosure rules that asset managers and hedge funds must comply with. These rules help establish control and trigger warnings in a timely manner, ensuring that the interests of the market and investors are not compromised.

Shareholding Disclosure Rules

Not a cakewalk!

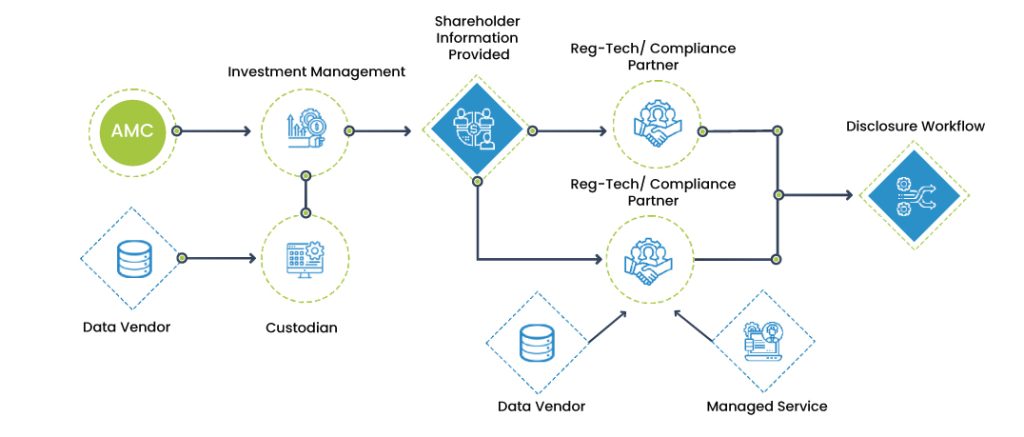

Although not keeping an updated record of shareholding can result in serious consequences, keeping track of shareholder data and voting rights is not a simple task that can be done with a flick of a wrist like a magic trick. Many firms still rely on manual data collection and aggregation, making the process even more challenging. This is how the traditional, largely manual As-Is business flow for shareholder disclosure and shareholder data management operates:

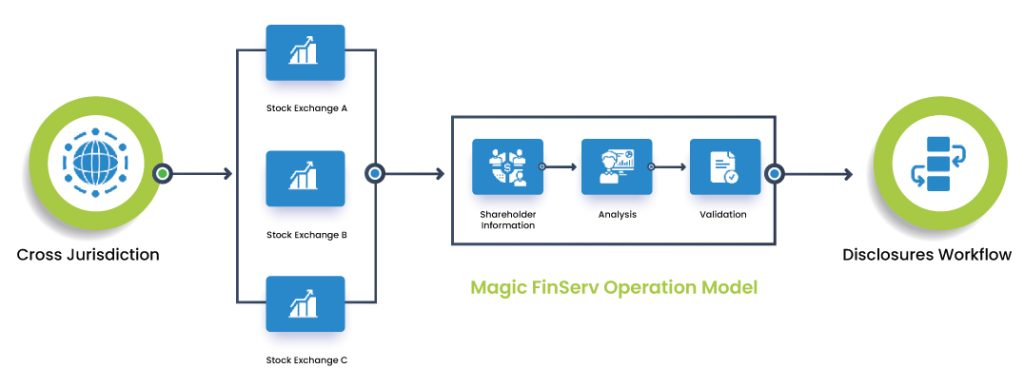

Secondly, globalization has led to firms investing in equities globally. This trend has made shareholder data management complicated, as firms now have to contend with multiple jurisdictions.

Getting Clear and Updated Shareholding Data! What are the options available?

Asset managers require a comprehensive understanding and reporting of various types of shares, including equity shares, authorized share capital, issued share capital, right shares, bonus shares, sweat equity shares, preference shares, cumulative and non-cumulative preference shares, participating and non-participating preference shares, and convertible and non-convertible preference shares. These shares should be available in both structured and unstructured formats within company reports such as the balance sheet and financial statement, as well as data terminals.

Additionally, it is necessary to consolidate and aggregate the different types of shares mentioned earlier. A precise centralized data system must be in place, complete with a rule-based intelligent process that accesses data sources in a timely manner and stays up to date with corporate events that impact shareholding and voting rights.

As highlighted earlier, managers who hold international stock holdings that fall under different jurisdictions face complex regulatory and compliance issues. For example, the company issuing the stocks, also known as the issuer, may have different share capital requirements depending on the jurisdiction and market, including preference shares, unlisted shares, or derivatives trading.

As an asset manager or hedge fund, firms have three options to consider:

A) They could use their own platform/product to process compliance or regulatory filings. This would result in the firm managing shareholder information on its own while using the data services of a data vendor.

B) Alternatively, the fund could use the services of a third-party platform such as a Reg-Tech and compliance product. In this case, the third-party platform/product would use shareholder information from another data provider for the securities portion of the portfolio. The third-party organization will charge costs depending on the jurisdiction they are covering, as this is an on-demand service.

C) Alternatively, funds and wealth managers could outsource the shareholder disclosure and reporting task in its entirety to a BPM vendor to save time and effort while keeping up with the latest requirements. This would give them everlasting peace of mind as they would no longer have to worry about missing deadlines or regulatory requirements.

Process Automation: Benefits of Automated, Rules-Based, Comprehensive, End-to-End Solution

Since the 2008 financial crisis, shareholding disclosures have become an obligatory reporting requirement. However, over the years, the associated complexities with reporting have increased manifold. It is no longer feasible to manually review financial statements and public website data to ensure timely compliance. Process automation is the solution to simplify shareholder data management and shareholding disclosures, ensuring accurate and timely insights for downstream calculation, compliance adherence, and other activities related to the organization's health.

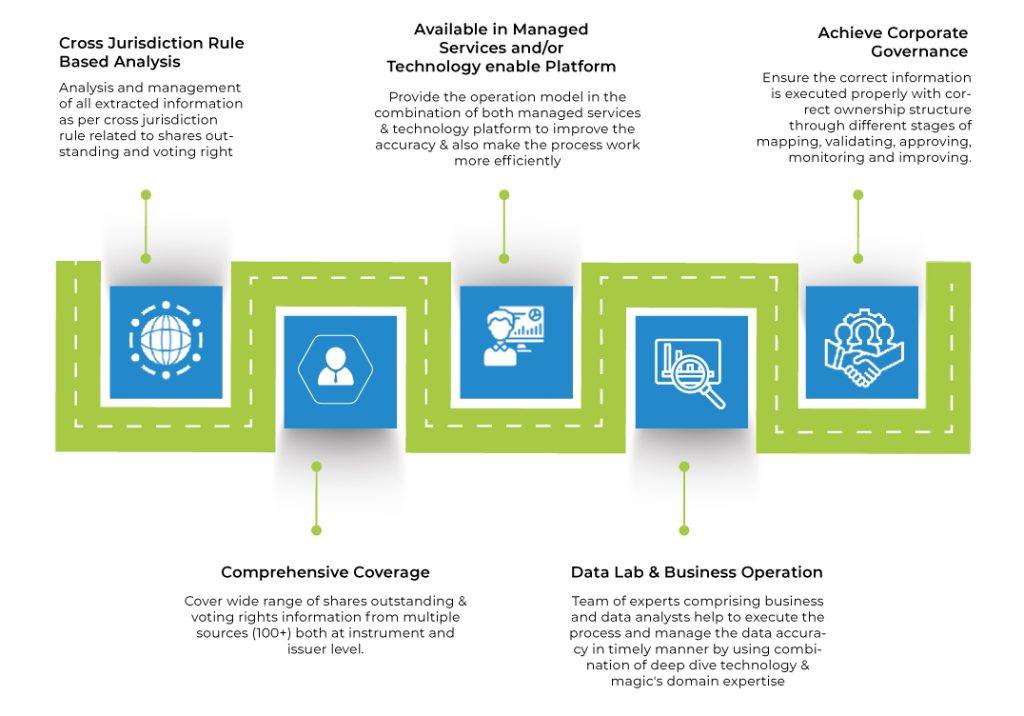

A complete end-to-end niche solution, like the one offered by Magic FinServ, that combines technology and managed services and is driven by a team of experts in both the financial and technology domains, can help eliminate the pain points associated with shareholder data management and shareholding disclosures. With a unique "rule-driven" solution that aligns with geographical requirements, such a solution can keep funds and wealth managers up to date with the latest developments.

Key Features of Magic FinServ's Solution Component:

- Data Management: This feature manages all instrument identifier data and all other information required for extracting information from exchanges in multiple jurisdictions.

- Document Record Management: This feature manages all documents and stores them in a structured or normal PDF format after conversion from unstructured formats.

- Rule Engine: The rule-based engine is a critical component of Magic FinServ's offering as it defines the rules for extracting information from documents.

- API Integration: The solution can be easily integrated with other existing platforms and systems for data consumption.

- Reporting and Dashboard: This feature demonstrates and generates a report based on business criteria.

Solution Features

Timely and accurate data is always important, especially with regards to shareholding disclosure and voting rights, particularly when the threshold is crossed for substantial shareholders and takeover bids. However, extracting and feeding correct information into workflows can be an excruciating exercise and not as simple as pulling a rabbit out of a hat.

Magic FinServ helps achieve all the objectives mentioned earlier in a timely manner. This begins with tracking corporate action events, automatically accessing relevant notification sites, reading, and extracting the data to identify key value pairs, and transforming it to the investing company's data standards. Rules are then applied, and the final outcome is fetched into the investment table and various other reporting forms.

If you would like to learn more about how we can help, please connect with us today at mail@magicfinserv.com