Home » Keeping up with Sec T+1 Settlement Cycle!

INSIGHTS

Intelligent solutions. Informed decisions. Unrivaled results.

Keeping up with Sec T+1 Settlement Cycle!

Standardizing Broker to Regulatory Authority (SEC/FINRA) Communication with DeepSightTM

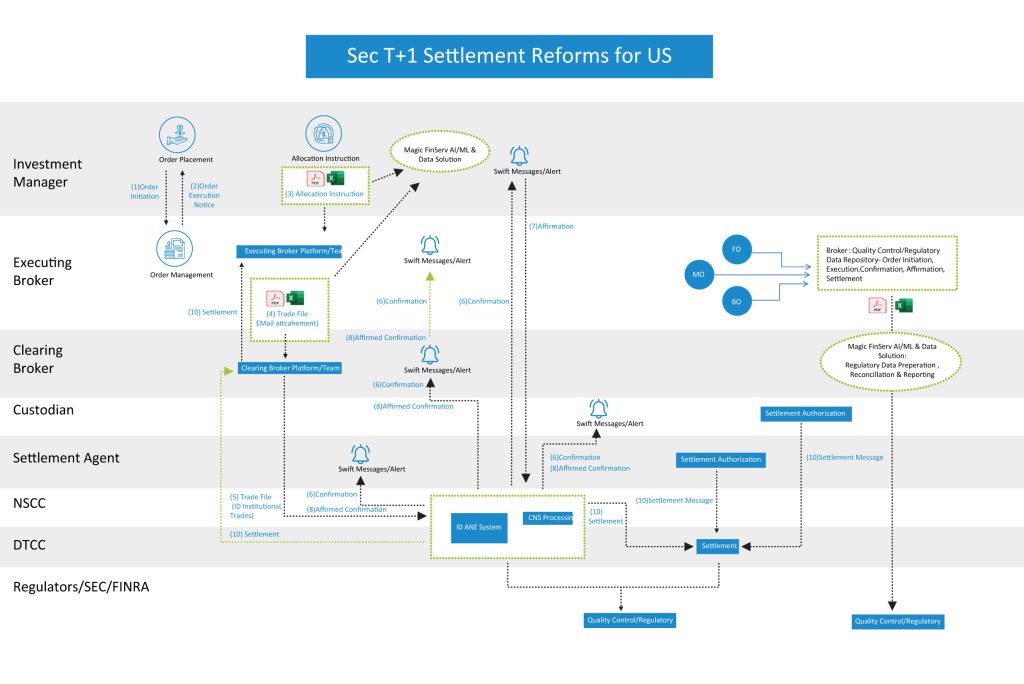

We trust you were able to read our first blog (Are you ready for Sec T+1 Settlement reforms?) on the impending shift to T+1 settlement in the US, where we highlighted the reasons why broker-dealers and clearing brokers must automate and standardize communication related to trade. Here in this blog, we evaluate why regulatory filings must be automated as well.

Once a trade has been executed, the broker-dealer is expected to update the regulatory body as the case might be, with appropriate details related to the trade transaction. These reports or regulatory filings are a comprehensive summary of the trade that is submitted to the regulatory bodies on a timely basis. Regulatory filings involve trade status and timestamp details for all the actions like Order Initiation, Execution, confirmation, affirmation, matching, settlement, partially settle, rebook etc. In case there is a settlement failure or a rebooking, the broker dealer is expected to update the regulatory authority on that as well. The sole objective of this regulatory filing is to ensure transparency and to enable the regulator to assess and supervise the business being transacted by individual Counterparties within the marketplace. It is critical for protecting the interests of the investor and keeping the integrity and the security of the capital markets intact.

Typical Challenges in Regulatory Filings

Provided below are some of the typical challenges that broker-dealers face in ensuring a timely delivery of regulatory filings:

Operational Risk: Broker/dealers carry out trade lifecycle operations across multiple platforms and FinTech systems, often relying on complex manual processes to bridge the gap between these disparate platforms. However, they frequently face challenges due to outdated legacy processes and system performance issues and most importantly Data transfer issues due to Data compatibility, which hinder their ability to file regulatory reports in a timely manner.

Asset challenges: Investment managers face challenges related to diverse Asset types, including equity, fixed income securities, and ETD derivatives. Regulatory requirements for each instrument depend on the market in which it is traded, such as Organized Trading Facility (OTF) or Regulated Market (RM), as well as the specific guidelines set by regulatory bodies like the SEC, FINRA, and CFTC. As a result, the regulatory filing process becomes complex when broker-dealers do not automate or use a rule-based approach for FO-MO-BO data reconciliation and transformation.

Data quality and governance challenges: Excessive reliance on manual labor only for the classifying, aggregating, consolidating, and validating data during the multiple stages of the trade – initiation, confirmation, affirmation, rebooking, settlement constitutes a problem when it comes to meeting regulatory timelines or ensuring that all data is up-to-date and accurate.

STP challenges: All broker-dealers are typically required to report trade details to the SEC and other regulatory bodies in a timely manner. The reporting frequency and specific deadlines for filing these reports can vary based on the size and activities of the broker-dealer. In the absence of automation and STP, timely regulatory filings are difficult.

Finding the right vendor: Finding the right vendors for automating processes without impacting the existing business activities might not be as easy as expected. And that's why broker-dealers need a partner with a thorough understanding of the capital markets and are capable of designing solutions that are tailored to fit.

Automating Regulatory Filing with Magic DeepSightTM : The 7-point advantage

Capitalizing on its immense experience in Capital and Financial Markets, and bespoke AI/ML platform that customizes solutions as per need, Magic FinServ ensures that regulatory filings are seamless and smoother than before - beginning with faster, smoother, aggregation and consolidation of data (using automation) and benefiting from a rules-based approach that adapts to evolving regulatory environment (including shift to T+1, and others) easily.

- Ensures data quality and governance: An AI-enabled platform like DeepSight can make a huge difference in the quality of data. Instead of inaccurate, inconsistent, and incomplete data, from manual data entry, broker-dealers are assured of clean, complete, consistent, and accurate data, for submission to the SEC and other regulatory bodies. DeepSight also validates and cross-references data, further minimizing the likelihood of errors and discrepancies. Most importantly is also creates an audit trail thereby enabling replaying of the transaction if needed.

- Simplifying reconciliation/transformation of trade data: An AI/ML and rules-based solution can ensure a faster, smoother, and more accurate reconciliation and transformation of trade data emanating between the front, middle, and back office when compared to the manual approach. This is most critical as the Data Models, Formats and Templates differ for each application and area, a key reason why the manual approach is simply not feasible for the impending T+1 settlement cycle.

- Easy integration: DeepSight can be easily integrated with existing systems. It supports data in all formats. The platform is format-agnostic and has the capability to support all sorts of data formats such as Excel files and spreadsheets, CSV files, emails and attached documents, API integration from multiple systems, and unstructured data.

- Shared database for data multi-purposing: Whatever the file format, DeepSight parses through data seamlessly from disparate sources such as back office, middle office, front office and processes, transforms, enriches it, and creates a single source of truth in a shared location or database.

- Enables timeliness and compliance: With DeepSight, broker-dealers can ensure that regulatory filings are done as per the timelines set by the regulatory authority. By automating the workflows, extracting the data from multiple sources (the back, middle, and front offices) and compiling it together becomes easier.

- Single solution: Straight through processing (STP) results in seamless and smoother regulatory filing. This integration enables seamless data flow and enhances overall workflow optimization. It reduces manual data transfer and improves the accuracy and efficiency of the trade reporting process.

- Adopt new regulatory changes easily with a rules-based approach: In an evolving regulatory environment, a rules-based solution makes it easier to reconcile data and file reports with the regulatory body becomes easier.

As the market gears up for T+1, this was how we could enable your transition to it. For more you can write to us mail@magicfinserv.com.