Home » Diversity, Equity, and Inclusion (DE&I): How Asset and Mutual Funds Managers Win Investor Confidence with Intelligent Tools

INSIGHTS

Intelligent solutions. Informed decisions. Unrivaled results.

Diversity, Equity, and Inclusion (DE&I): How Asset and Mutual Funds Managers Win Investor Confidence with Intelligent Tools

Investors are increasingly looking at how organizations are embracing diversity, equity, and inclusion. If we look at it from the ESG (Environmental, Social, and Governance) perspective: the diversity, equity, and inclusion triad are the "S" in ESG and are as important as the "E" or environmental impact component.

With DE&I, investors are trying to measure how organizations discharge their responsibility towards their people — employees, contractors, customers, vendors, and investors. They are looking at quantifying the value of a firm based on its DE&I measures, and it is increasingly becoming important as investment opportunities are tied to it.

Let us consider the following two scenarios:

As a Mutual Fund, Portfolio Management, or Asset Manager, you are obligated to ensure conformity with the changing preferences of the millennial investors who are picky when it comes to issues like sustainability and inclusivity. For a delightful customer experience, you must be willing to tread the extra mile. It would be a clear breach of trust if their funds are somehow not found to be as sustainable as they expect them to be.

As a Fintech or Financial Organization, vetting the investor enthusiasm/confidence in your offerings or services could be a steep climb and more so when you have absolutely no idea how to compile and aggregate all the data you have related to the DE&I efforts that you have undertaken, as the millennial investor pushes the boundaries of stakeholder capitalism.

You can onboard additional skills, but why burden your existing teams or spend countless dollars in cleaning and compiling data when there are intelligent tools like Magic FinServ's DeepSightTM to compile and aggregate data in one common repository?

Let us first decode what are the DE&I guidelines.

What is DE&I?

- Diversity: Accept differences whether of race, creed, ethnicity, gender identity, etc., in the workplace.

- Equity: Provide equal access or equal opportunities for pay, promotion, training, and other aspects of employment, regardless of race, creed, color, sexual orientation, age, etc.

- Inclusion: Foster a sense of empowerment and belongingness.

Why DE&I matters

Whether you are actively promoting DE&I or choose to do it subtly, there is no questioning that the stakes have been raised, and hence showcasing your DE&I initiatives gives you a competitive advantage.

- Investors are actively pursuing stakeholder capitalism: Stakeholder capitalism is quite simply a system that ensures that the interests of all stakeholders - customers, suppliers, employees, shareholders, and local communities, are kept in mind and pursued to ensure long-term value creation as engagement/relationship between the multiple parties progresses. With businesses today pursuing this new business model, promoting DE&I initiatives beyond tokenism becomes necessary.

- ESG is part of institutional investors' big vision: Institutional investors are keenly considering ESG as part of their vision, mission, values, and operations, and are actively seeking organizations that promote or adhere to these values and hence the need to showcase the DE&I efforts whether you are a mutual fund or a portfolio manager or asset manager or even a fintech or financial institution desiring be a part of the investor's big vision.

- The investor has the right to know: As organizations could either be explicit in their support of DE&I like Quicken Loans, with a vision and mission statement showcasing their DE&I commitment and ensuring that all reports pertaining to DE&I efforts are made available on public channels that can be accessed free or for a price like GRI (Global Reporting Initiative), Bloomberg, Refinitiv, etc., or it could be subtle about their DE&I commitments, either way the investor has the right to know.

As an Institute for Sustainable Investing, Morgan Stanley states, "Increasingly proactive, individual investors seek products and solutions across asset classes tailored to their interests. They also want to measure the environmental and social impact of their investments." - There's evidence that DE&I promotes innovation and productivity: From the perspective of organizational efficiency and productivity, there is enough evidence to indicate that gender diversity and inclusivity result in greater productivity and innovative thinking. For Asset Management Firms, there iss enough evidence to prove that diversity and inclusion can in fact enhance the risk-return characteristics of investment portfolios. (Source: SASB)

- Walking the talk and not forgetting the governance aspect: It is not enough to spell out your commitments, you must be ready to walk the talk. The governance aspect of ESG is unarguably the most crucial element of ESG because it highlights the policy decisions taken by a company with respect to DE&I and how deliberate actions are taken in this regard.

Where to find DE&I data?

Here are some of the commonest sources where you can find information related to an organizations DE&I’ measures.

Employment Information Report (EEO-1):

Component 1 of the EEO-1 reporting is one of the tools for evaluating diversity. It is an obligatory filing,

On May 17, 2022, all employers in the United States of America, with 100 or more employees submitted Employment Information Report (EEO–1) report on the Equal Employment Opportunity Commission (EEOC) portal. The survey contains inputs on demographic workforce data, including data by race/ethnicity, sex, and job categories, and is an obligatory filing as per federal regulations.

Platforms for Disclosure for Diversity and Inclusion efforts

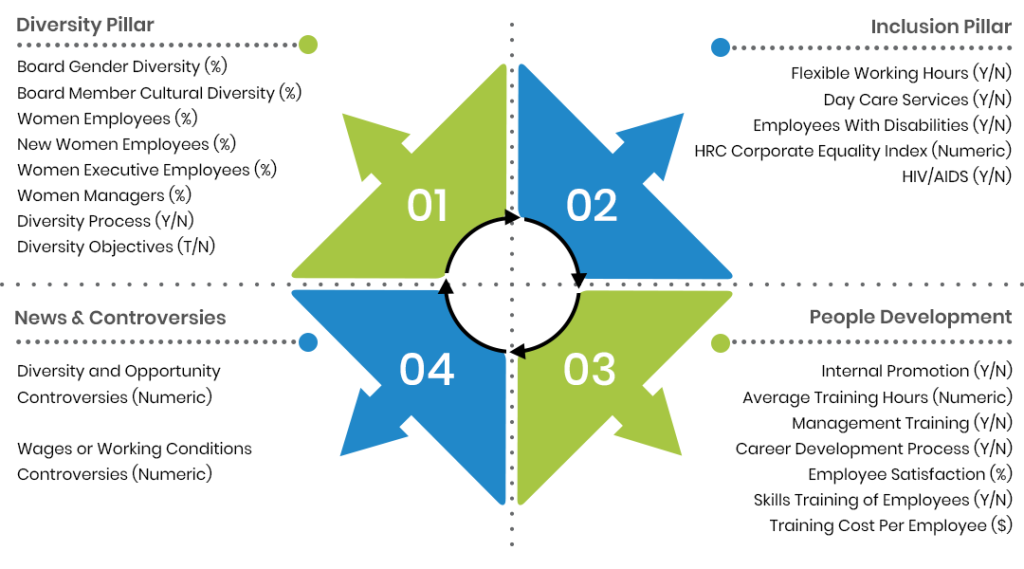

With data collected from the public domain, Refinitiv Diversity & Inclusion Ratings ranks over 12,000 publicly listed companies based on their diversity and inclusion efforts across 24 separate metrics enlisted below. The pillars across which the efforts are computed include the Diversity Pillar, Inclusion Pillar, News and Controversies, and People development.

Bloomberg's GEI index: There are five metrics across which an organization's efforts related to gender inclusivity are measured. These include female leadership and talent pipeline, equal pay and gender pay parity, inclusive culture, sexual harassment policies, and a pro-women brand image.

GRI Equality and Diversity Standards

The GRI (Global Reporting Initiative) Equality and Diversity Standards is one of the most notable frameworks for ESG and helps in providing a glimpse into the sustainability standards.

Like Quicken Loans, there are many financial organizations notably – EY, PWC, USAA, Visa, and Amercian Express, that are explicit about their mission to promote a diverse and culturally inclusive workplace. They have statements to that effect on their websites and on their mission and vision statements.

Unstructured data and social media

And lastly, there is a massive amount of unstructured data existing in organization websites, public press releases, annual reports, investor briefings, brochures, organizational collaterals, spreadsheets, social media platforms etc., that provide a clue about the organization's DE&I initiatives, which ideally must be compiled in a single repository. However, since it is not counted as core revenue-generating activity, this task is long overdue in many organizations. . There are other sources of unstructured data such as HR initiatives and organizational culture, which can provide a comprehensive view of an organization's diversity and gender inclusivity efforts, but which remain hidden as organizations lack resources and the mindset to aggregate them in one place.

In a Nutshell

Today, some organizations are very vocal about their DE&I practices, and they make it a formal affair to showcase their focus and support on the same by publicly listing on their websites, they have a specific DE&I related reporting and so on. But there are some other organizations which may not be vocal but are supportive and we can notice their support through social media channels, websites, annual reporting and much more. So, there are two parts-

Formal Regulatory Reporting which has been asked by EEO commission and requires to submit a report, and organizations have made it available on their website, in their mission statements etc.

Voluntary Reporting – This is where organizations support the DE&I norms as it is a part pf ESG framework, and all of this is available across organizations various platforms and channels in unstructured way.

So, DE&I is becoming increasingly important aspect both from companies' perspective as well as cultural perspective as research has shown that the companies which practice DEI (Diversity, Equity, and Inclusion) have been seen to be taking better decisions as it has got diverse culture and people across the organization.

As an investor or an analyst who wanted to take a call based on DE&I performance – our process optimization platform - DeepSightTM can support both sides of a coin. It can compile all the organization data which is present in unstructured formats and help prepare those DE&I reports and for the analysts when they are investing and their major issue is DE&I, it can make all the multiple reportings accessible to them.

The Big Question? How to Build Reliable Data

The big question is how to collate and compile data for relevant insights. Extracting insightful data is easier said than done. How does a company assess inclusion and belonging? We have everyone, from the regulators to the investors and shareholders, and employees and new recruits questioning "Where are the numbers?"

Manual data extraction is impossible as data is far too fragmented, there are multiple frameworks such as the GRI, SSB, Bloomberg, and Refinitive, among others, where organizations file their details, and multiple and varied unstructured data sources that must be considered for a complete round-up of the organization's DE&I initiatives.

Data Compilation and Extraction with Magic DeepSightTM

In the fast-paced business environment that Asset Managers and Mutual Funds work in where data is typically updated every minute on multiple websites and a similar amount of unstructured data is also generated every day, going through zillions of data manually is indeed a cumbersome task.

Instead, intelligent tools relying on OCR, NLP, AI, and ML can make it easier for these analytics-driven organizations to not only extract data, but systematically examine data for validity and conformity using means like rules, algorithms, look-up tables, etc.

An intelligent rules-based tool and process optimization platform DeepSightTM when leveraged appropriately can significantly help ensure transparency and accessibility of the DE&I data by first ensuring extracting the relevant data elements at significantly fewer costs and compiling, cleaning, validating, and augmenting that data so that they can be fair and ethical when making investment decisions. We will help you adopt the best approach powered by AI (Artificial Intelligence) and machine learning for eliminating the scattered and siloed legacy of demographic data while ensuring visibility and accessibility. Share the nature of your concern, or write to us mail@magicfinserv.com.