Home » Consolidated Data Empowers Wealth Managers to execute their Fiduciary Duties Effectively

INSIGHTS

Intelligent solutions. Informed decisions. Unrivaled results.

Consolidated Data Empowers Wealth Managers to execute their Fiduciary Duties Effectively

All of a sudden there has been an increasing consensus that wealth management advisory services are something that we all need – not just for utilizing our corpus better, but also for gaining more accurate insights about what to do with our monies – now that there are so many options available. This has been partly due to the proliferation of platforms including the Robo- advisory services that deliver financial information on the fly. And partly due to psychological reasons. We all have heard stories of how investing "smart" in stocks, bonds, and securities resulted in a financial windfall and ludicrous amounts of wealth coming into the hand of the lucky ones while with our fixed income and assets we only ended up with steady gains over the years. So yes, we all want to be that "lucky one" and want our money to be invested better!

Carrying out the Fiduciary Duties!

But this blog is not about how to invest "smart." Rather the focus is on wealth managers, asset managers, brokers, Registered Investment Advisors (RIA), etc., and the challenges they face while executing their fiduciary duties.

As per the Standard of Conduct for Investment Advisers, there are certain fiduciary duties that the financial advisors/ investment advisors are obligated to adhere to, for example, there's the Duty of Care which makes it obligatory for investment advisors to ensure the best interests of the client and:

- Provide advice that is in the clients’ best interests

- Seek best execution

- Provide advice and monitoring over the course of the relationship

However, due to multiple challenges - primarily related to the assimilation of data, that makes it difficult to fulfil the fiduciary obligations. The question then is how wealth managers can successfully operate in complex situations and with clients with large portfolios and retain the personal touch.

The challenges enroute

Investors today desire, apart from omnichannel access, integration of banking and wealth management services, and personalized offerings, and are looking at wealth advisors that can deliver all three. In fact, fully 50 percent of high-net-worth (HNW) and affluent clients say their primary wealth manager should improve digital capabilities across the board. (Source: McKinsey)

Lack of integration between different systems: The lack of integration between different systems is a major roadblock for the wealth manager, as is the lack of appropriate tools for cleaning and structuring data. As a result, wealth management and advisory end up generating a lot of noise for the client.

Multiple assets and lack of visibility: As a financial advisor, the client's best interests are paramount. Visibility into the various assets the client possesses is essential. But what if the advisor does not see everything? As the client has multiple assets - retirement plan, stock and bond allocations, insurance policy, private equity investments, hedge funds, and others, without visibility how can you execute your fiduciary duties to the best of your ability.

Data existing in silos: The problem of data existing in silos is a huge problem in the financial services sector. Wealth managers, asset managers, banks, and the RIAs require a consolidated position of the clients’ portfolios, so that no matter the type of asset class, the data is continually updated and made available. Let's take the example of the 401K - the most popular retirement plan in America. Ideally, all the retirement plan accounts should be integrated. However, when this is not the case, it becomes difficult to take care of the client's best interests.

Delivering personalized experience: One of the imperatives when it comes to financial advice is to ensure that insights or conversations are customized as per the customer's requirements. While someone might desire inputs in a pie chart form, others might require inputs in text form. So apart from analyzing and visualizing portfolio data, and communicating relevant insights, it is also essential to personalize reporting so that there is less noise.

Understanding of the customer's risk appetite: A comprehensive and complete view of the client's wealth – which includes the multiple asset classes in the portfolio – fixed income, alternative, equity, real assets, directly owned, is essential for an understanding of the risk appetite.

The epicenter of the problem is of course poor-quality data. Poor quality or incomplete data, or data existing in silos and not aggregated is the reason why wealth advisory firms falter when it comes to delivering sound fiduciary advice. They are unable to ascertain the risk appetite, or fix incomes, or access the risk profile of the basket (for portfolio trading). More importantly, they are unable to retain the customer. And that's a huge loss. Not to mention the woeful loss of resources and money when instead of acquiring new customers or advising clients, highly paid professionals spend their time in time-intensive portfolio management and compliance tasks and end up downloading tons of data in multiple formats for aggregation and then for analytics and wealth management.

Smart Wealth Management = Data Consolidation and Aggregation + Analytics for Smart Reporting

Data consolidation and aggregation is at the heart of wealth management practice. is undeniable.

- A complete view of all the customer's assets is essential - retirement plan, stock and bond allocations, insurance policy, private equity investments, hedge funds, and others.

- Aggregate all the assets. Bring together all multiple data sources/ custodians involved

- Automate the data aggregation and verification in the back office. Build the client relationships instead of manually going through data

- In-trend trading such as portfolio trading wherein a bundle of bonds of varying duration and credit quality are traded in one transaction. It requires sophisticated tools to access the risk profile of the whole basket (in the portfolio trade) (Source: Euromoney)

- Ensure enhanced reporting or sharing the data in the form that the customer requires – pie charts, text, etc., using sophisticated analytics tools for an uplifting client experience using a combination of business intelligence and analytics.

How can we help?

Leverage Magic DeepSightTM for data aggregation and empower your customers with insightful information

Magic FinServ's AI Optimization framework utilizing structured and unstructured data build tailored solutions for every kind of financial institution delivering investment advice – banks, wealth managers, brokers, RIAs, etc.

Here's one example of how our bespoke tool can accelerate and elevate the client experience.

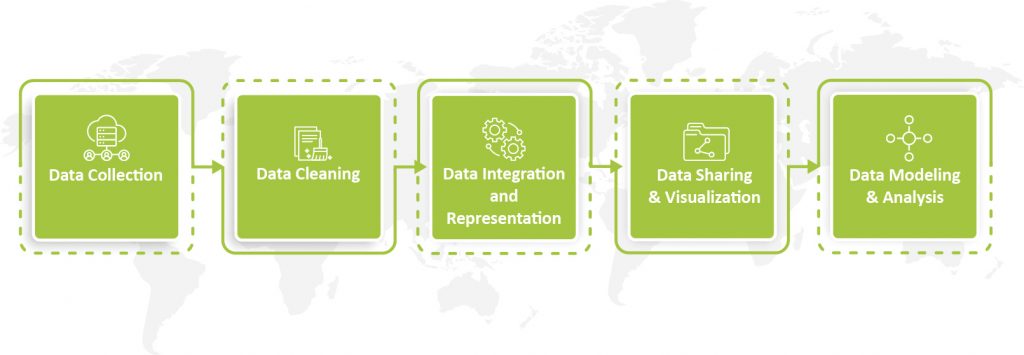

Data aggregation: Earlier we talked about data consolidation and aggregation. Here we have an example of how we can deliver on when it comes to clarity, speed, and meaningful insights from data. Every fund is obligated to publish its investment strategy quarterly. Magic FinServ's AI optimization framework can potentially provide the capability to read these details from public websites. Bringing together data from disparate sources and data stores and consolidating it by combining our bespoke technology - DeepSightTM - that has a proven capability to extract insights from data in public websites such as 401K, 10K as well as from unstructured sources such as emails and aggregate them to ensure a single source of truth, which provides intelligence and insights to carry out portfolio trading and balancing exercise, scenario balancing and forecasting among others.

Business Intelligence: Our expertise in building digital solutions that leverage content digitization and unstructured / alternative data using automation frameworks and tools improve trading outcomes in the financial services industry.

DCAM authorized partners: As DCAM authorized partners, leverage the best-in-class data management practices for evaluating and accessing data management programs, based on core data management principles.

Keeping up with the times:

The traditional world of Wealth Management Firms is going through a sea change. Partly due to the emergence of tech-savvy high-net-worth individuals (HNWI) who demand more in terms of content, and partly due to increasing role played by Artificial Intelligence, Machine Learning and natural language processing. Though, it is still the early days of AI, it is evident that in wealth management, technology is increasingly taking on a larger role in delivering content to the client while taking of aspects like cybersecurity, costs, back-office efficiency and automation, data analysis and personalized insights, forecasting and improving the overall customer experience.

To know more about how Magic FinServ can amplify your client experience, you can write to us mail@magicfinserv.com.