Home » Contract Data Management is Getting a Makeover with Artificial Intelligence and Machine Learning

INSIGHTS

Intelligent solutions. Informed decisions. Unrivaled results.

Contract Data Management is Getting a Makeover with Artificial Intelligence and Machine Learning

The Future's Getting Breathtakingly Simple

Before the Covid-19 pandemic, managing contracts was not an easy business. The legalese that contracts are clouded in, constitutes just a small fraction of the challenge that organizations face during contract management. The bigger challenge is the existence of contracts in diverse forms such as public websites, paper, emails, and ensuring that obligations are met in a timely manner so that there are no monetary losses or wranglings/disputes with the parties concerned later.

A change has been necessitated because as the world gets smaller, as borders fade out when it comes to doing business, and the number of stakeholders multiplies, the stakes have also become disproportionately high, and as a fintech or financial institution you simply cannot afford to leave anything to chance. Hence, the need for augmenting human intelligence and capacity with intelligent tools powered by Artificial Intelligence (AI) and Machine Learning (ML) and relying enormously on digitization capacities and the cloud for managing, storing, and interpreting contractual information effortlessly.

Demystifying the Reasons Behind the Shift!

Though contract data management has always been a long-winded and paper-heavy process, there has been a subtle shift post covid as organizations are becoming more open to using modern technology such as AI and ML post covid 19 for addressing many of their pain points post covid. This was primarily because, during the pandemic and post-it, organizations realized that they could not leave contract data management to the legal experts and the analysts (solely) anymore – for not only was it becoming extremely time-consuming and expensive, but also manual contract data management was proving incapable of providing the desired level of scalability and deep insight that organizations required. So, here's decoding why as a fintech or Financial Institution, Smarter Contract Lifecycle Data Management is critical for keeping pace in a changing business landscape.

A) Unstructured data in files, cabinets, and silos across the enterprise were difficult to access and update

When the pandemic struck, which was quite sudden, some organizations had either digitized their contracts and processes or hadn't. For those who hadn’t digitized the swathes of paper agreements or the contract management process, managing contracts turned into a nightmare as accessing files from the repositories or cabinets at a minute's notice was improbable. This probably was the biggest learning for organizations as they realized that digitization or cloud solutions/cloud-based contract lifecycle management (CLM) enabled a level of business continuity that was not possible when you were relying simply on paper agreements or contracts. If the challenge posed by unstructured data was not enough, the existence of structured data such as the ones in public repositories with multiple stakeholders and existing in silos enterprise-wide constituted another major challenge during the pandemic for the same reason of lack of accessibility.

B) Staying in control was difficult as there was limited visibility into data

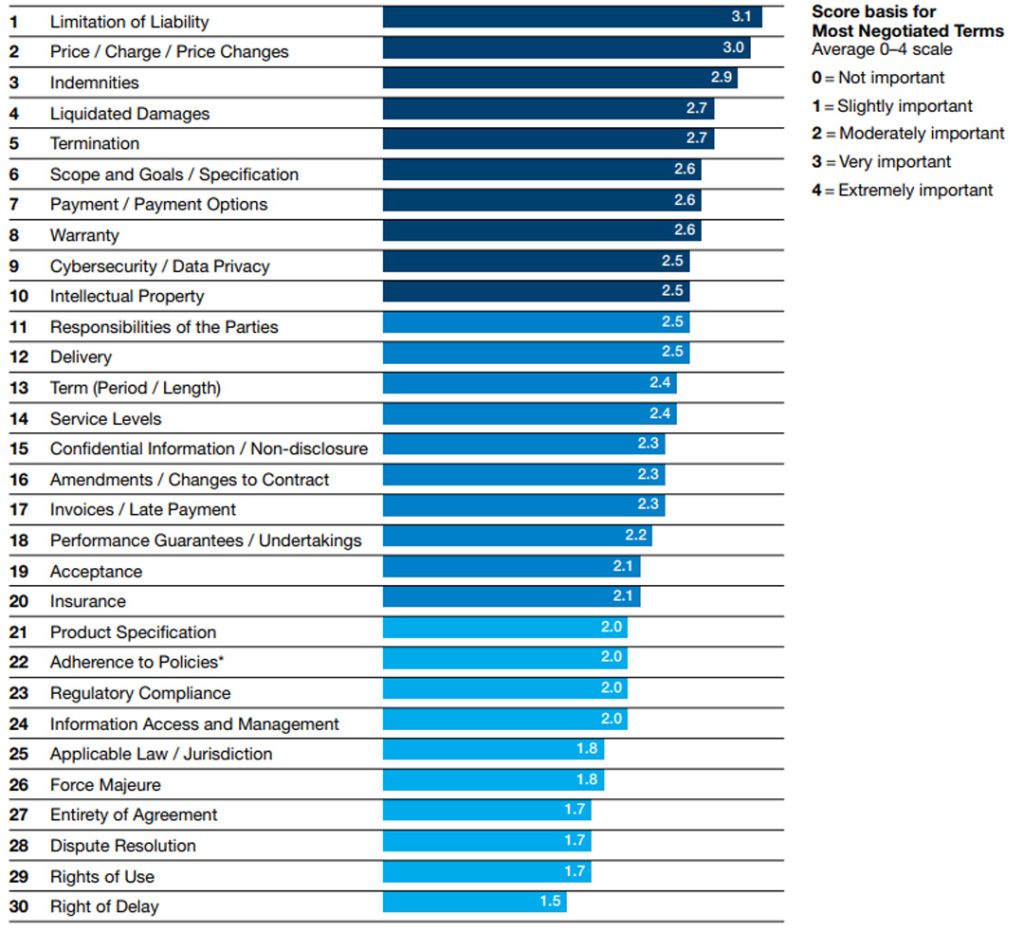

In 2020, the number of Force Majeure clauses invoked was a record high in many parts of the world. The force majeure clause implies an Act of God or some unforeseen circumstance, man-made or natural disaster that makes it difficult to fulfill certain obligations of the contract. By invoking this clause in the contract, the parties involved can protect themselves from liabilities that arise due to their failure to provide a certain service or product. Interestingly, the force majeure clause was rarely invoked prior to the pandemic, and if we were to go by the findings of the World Commerce & Contracting Report on the latest Most Negotiated Terms, 2022, it ranks a low 26 in the list of the most negotiated terms, but post the pandemic, it was one of the oft-invoked clauses.

In 2020, the number of Force Majeure clauses invoked was a record high in many parts of the world. The force majeure clause implies an Act of God or some unforeseen circumstance, man-made or natural disaster that makes it difficult to fulfill certain obligations of the contract. By invoking this clause in the contract, the parties involved can protect themselves from liabilities that arise due to their failure to provide a certain service or product. Interestingly, the force majeure clause was rarely invoked prior to the pandemic, and if we were to go by the findings of the World Commerce & Contracting Report on the latest Most Negotiated Terms, 2022, it ranks a low 26 in the list of the most negotiated terms, but post the pandemic, it was one of the oft-invoked clauses.

Today, it would not be hard to imagine how tricky, tiresome, and time-consuming would it be for a human, whether a legal expert or an analyst to skim manually past the swathes of paper contracts or public repositories for finding the terms and conditions associated with clauses such as termination, scope and goals, payment and payment options, data privacy, services levels, acceptance, regulatory compliance among others, and keeping up-to-date and in case of conditions such as the force majeure compliance among others, and keeping up-to-date and in case of conditions such as the force majeure how an untoward incident would have an impact on the organization. Considering the fast-paced business environment that the banks and FinTechs are operating in, finding, updating, and validating the relevant information manually is totally undesirable. However, with intelligent contract data management solutions, and automated solutions, it takes no time to extract, update, validate and monitor information that is required for keeping up to date.

C) Making intelligent decisions was difficult without appropriate tools, approaches, and technology

During the contract data management lifecycle, organizations get the best value from the services or products that must make intelligent decisions. They must access data quicker and faster than ever before. However, with data existing in silos, and in multiple formats, a data swamp builds up over the course of time. In order to make intelligent decisions faster, all data about a particular contract must be in one place instead of clustered everywhere. Using a combination of intelligent tools, powered with artificial intelligence and rules-based engines with capacities for learning and robust data management practices and metadata – a unique identifier without which one would have to wade to tons of data, organizations can take accurate and on-time decisions.

D) The realization that a centralized source of truth is more readily accessible than a file or a cabinet or data in silos

A unique centralized repository where you can store all your data in a digital format is better equipped to handle the challenges of the next-gen contract management lifecycle than the outdated physical file or cabinet. It is bestowed with dynamism thanks to automation, a unique digital repository centralized repository where it is readily available along with metadata, making it much more convenient for organizations than a filing cabinet or a siloed existence.

The Future in Simplicity

Contract data management does not end with the negotiations and signing of the contract between the parties. There is a lot of work that goes in the management of a contract such as keeping up to date, remaining compliant, and realizing maximum benefits, and for that contract management must be made simpler so that there is on-time/on-demand information.

As a financial institution, if you are unable to access information about the contract that you have signed in time and make decisions accordingly, you expose yourself to needless disputes and wranglings later, and are burdened with higher costs, poor performance, unnecessary risks, etc. Contract intelligence solutions begin by centralizing and streamlining contracts providing visibility into all contract data, thus empowering the organization to efficiently monitor all contractual and regulatory compliance obligations. That is the first step to simplifying it.

In the next blog, we will tackle the tools and technologies that make contract management more intelligent and how Magic DeepSightTM enables it. Magic’s DeepSightTM the process optimization platform along with our Advisory practice provides a configured solution that acts as a virtual assistant to the analyst thereby reducing the complexity of the task. It automates standard processes to reduce errors and omissions and enables the less experienced and less skilled analysts to be able to perform their tasks. Stay Tuned!